- Netherlands

- /

- Capital Markets

- /

- ENXTAM:FLOW

Here's Why I Think Flow Traders (AMS:FLOW) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Flow Traders (AMS:FLOW). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Flow Traders

How Quickly Is Flow Traders Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Flow Traders's stratospheric annual EPS growth of 54%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

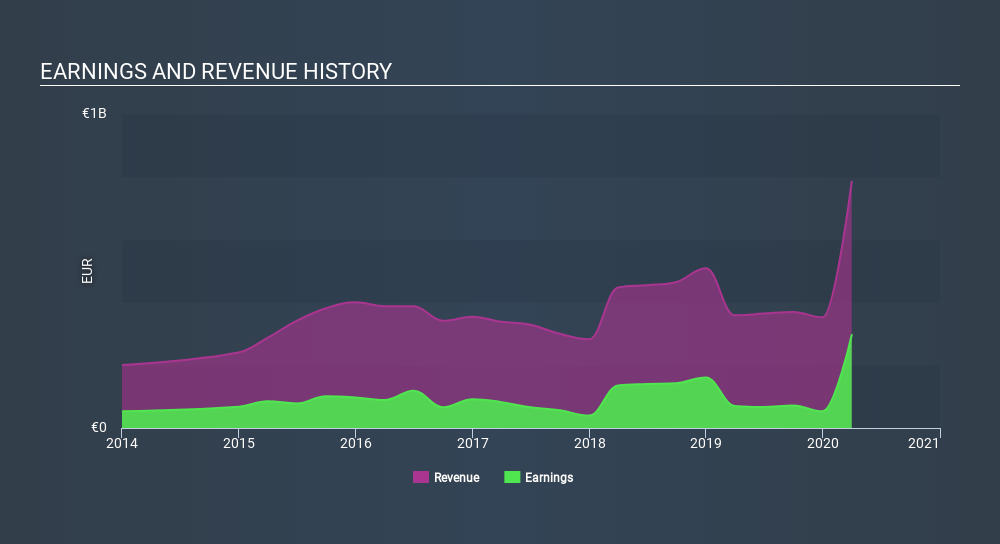

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Flow Traders's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Flow Traders shareholders can take confidence from the fact that EBIT margins are up from 39% to 54%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Flow Traders EPS 100% free.

Are Flow Traders Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first; I didn't see insiders sell Flow Traders shares in the last year. But the really good news is that Chief Trading Officer & Member of the Management Board Folkert Joling spent €284k buying stock stock, at an average price of around €28.40. Big buys like that give me a sense of opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Flow Traders bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping €47m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Dennis Matthijs Dijkstra, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Flow Traders with market caps between €920m and €2.9b is about €1.9m.

The CEO of Flow Traders only received €695k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Flow Traders To Your Watchlist?

Flow Traders's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Flow Traders belongs on the top of your watchlist. We should say that we've discovered 4 warning signs for Flow Traders (2 are potentially serious!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Flow Traders, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:FLOW

Flow Traders

Operates as a financial technology-enabled multi-asset class liquidity provider in Europe, the Americas, and Asia.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives