- Netherlands

- /

- Capital Markets

- /

- ENXTAM:FLOW

Flow Traders (AMS:FLOW) shareholders notch a 29% return over 1 year, yet earnings have been shrinking

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. To wit, the Flow Traders Ltd. (AMS:FLOW) share price is 28% higher than it was a year ago, much better than the market return of around 5.0% (not including dividends) in the same period. So that should have shareholders smiling. Unfortunately the longer term returns are not so good, with the stock falling 28% in the last three years.

Since it's been a strong week for Flow Traders shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Flow Traders

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Flow Traders actually saw its earnings per share drop 18%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

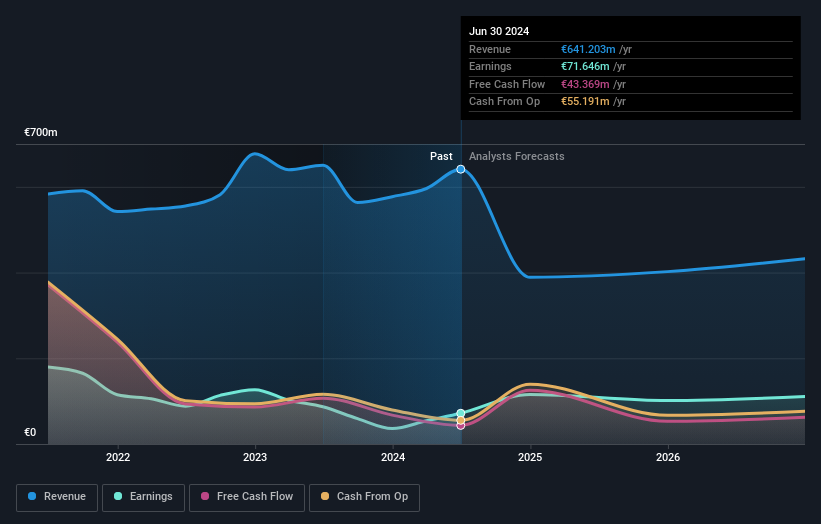

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Flow Traders stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Flow Traders shareholders have received a total shareholder return of 29% over one year. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Is Flow Traders cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

If you're looking to trade Flow Traders, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FLOW

Flow Traders

Operates as a financial technology-enabled multi-asset class liquidity provider in Europe, the Americas, and Asia.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives