- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:EXO

Is There Now an Opportunity in Exor After Shares Fall 14% Over the Past Year?

Reviewed by Simply Wall St

Thinking about what to do with your Exor stock? You are not alone. The Italian holding giant has had a bumpy ride lately, but if you are looking past the noise, there might be some real opportunities under the surface. Over the last year, Exor shares have slipped by 14.3%, and even in 2024, the stock is down 5.5% year to date. That said, if you zoom out to the three-year mark, Exor is up by a remarkable 29.1%. This seesaw performance speaks as much to shifting market sentiment as it does to underlying fundamentals. Recently, investors have recalibrated their risks on holding companies, possibly tied to broader European economic questions and sector rotations.

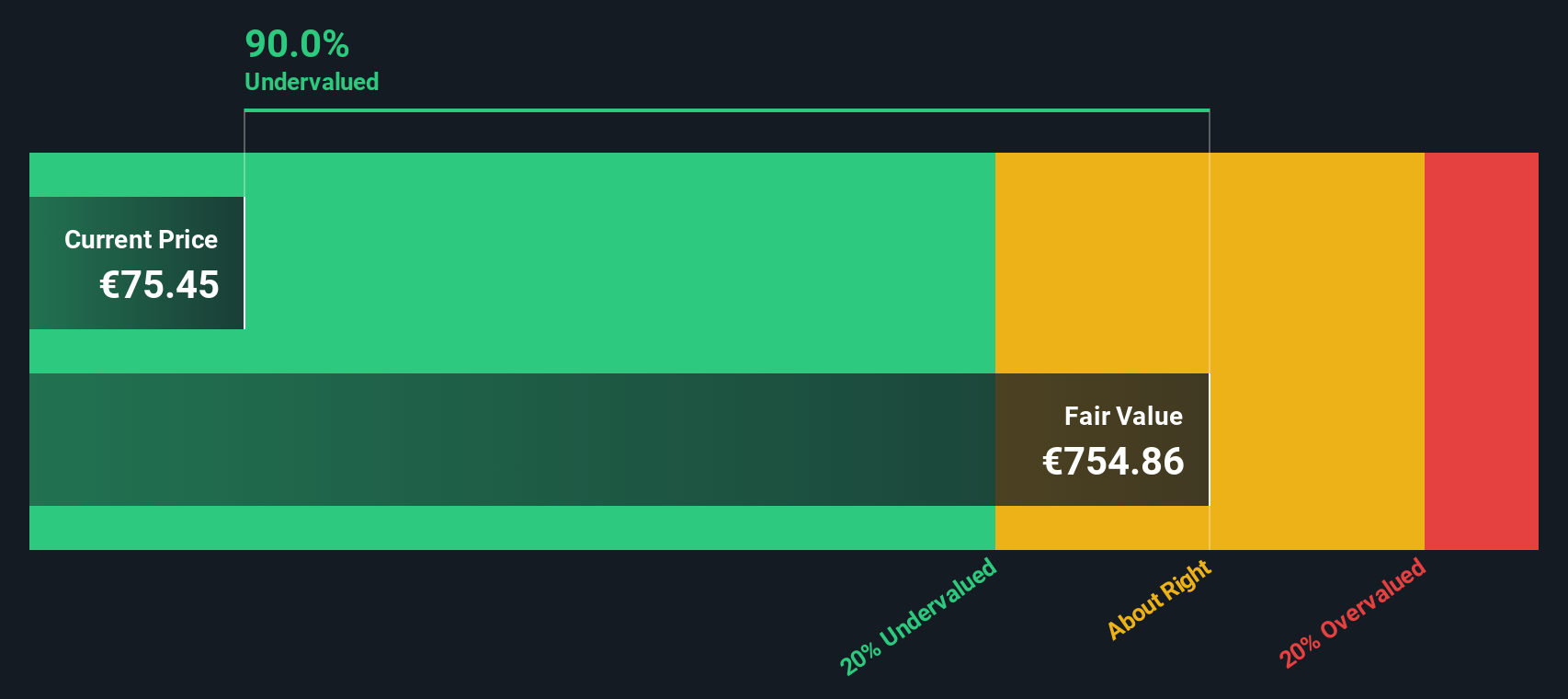

But here is where it gets interesting: on the numbers, Exor stands out. The company scores a 6 on our valuation score. That is the maximum, meaning it comes out as undervalued on all six valuation checks we review. That is not something you see every day, especially for a diversified business with family roots and global exposure like Exor. With all this in mind, let us dig into the different ways we can value Exor to help you decide whether it is worth adding to your portfolio right now. And stay tuned, because at the end, I will share a method that could give you an even better read on its true value.

Why Exor is lagging behind its peersApproach 1: Exor Excess Returns Analysis

The Excess Returns valuation model examines how efficiently a company utilizes its equity, moving beyond simple book value and focusing on returns that exceed the cost of equity. In Exor’s case, this approach highlights both its strengths and the possibility that the market is underestimating them.

For Exor, the book value per share is €178.78, with an average Return on Equity (ROE) of 19.43%. Over the past five years, the company’s stable earnings per share (EPS) have averaged €19.18, supported by a cost of equity of €5.81 per share. This results in an excess return of €13.37 per share, demonstrating Exor’s ability to create significant value above what investors require for their capital. The stable book value used in this model is €98.73 per share, providing a conservative baseline for future performance projections.

This analysis places Exor’s intrinsic value at approximately 79.6% above the current market price, which suggests the stock may be significantly undervalued by the broader market.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Exor.

Approach 2: Exor Price vs Earnings

The price-to-earnings (PE) ratio is a widely trusted valuation metric for profitable companies like Exor, since it links the current share price to the company’s profit-generating power. PE is especially relevant when a business reports stable or growing earnings, as it allows investors to measure how much they are paying for each euro of earnings in comparison to the broader market, its peers, and future growth prospects.

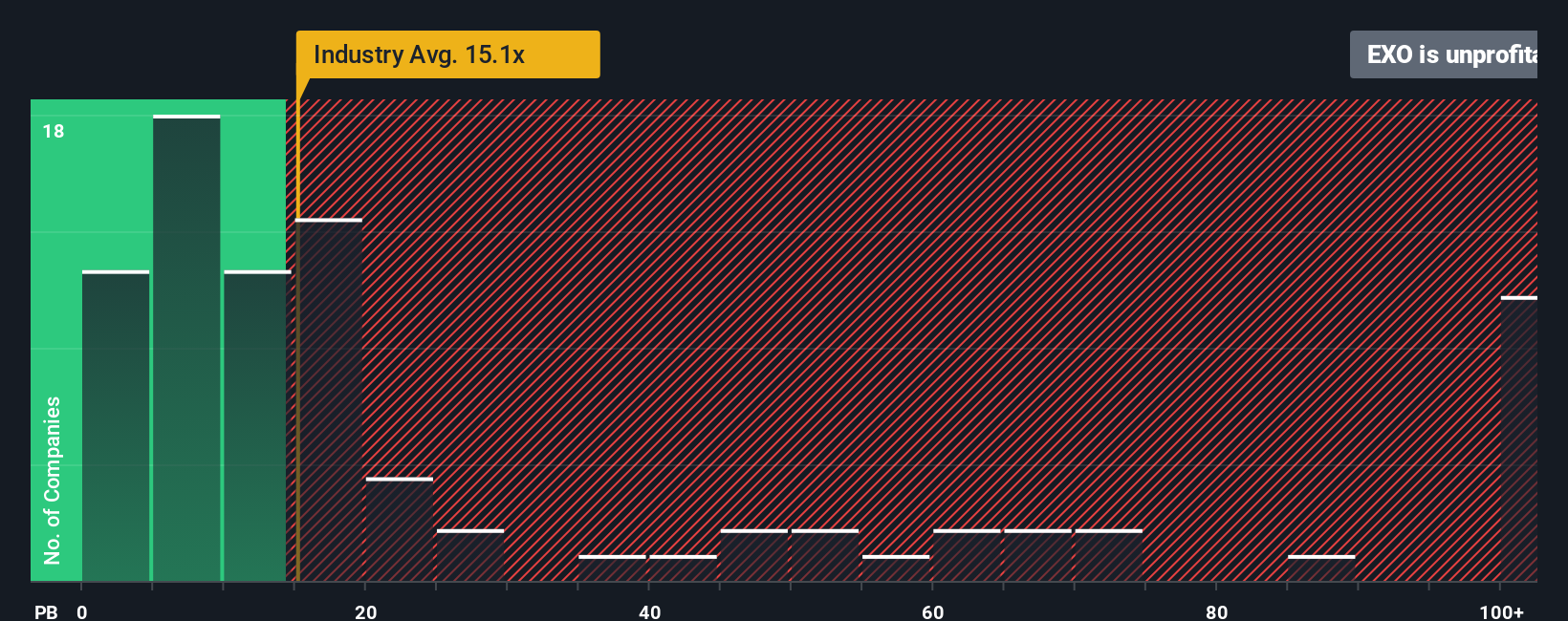

The acceptable or “fair” PE ratio for any company depends on growth expectations and risk. Businesses with predictable earnings growth and lower risks tend to trade at higher multiples, while those with unclear prospects or greater volatility command lower ones. Exor’s current PE ratio stands at 1.19x. This is well below the Diversified Financial industry average of 15.24x and considerably less than the peer group average of 21.99x. This low multiple could signal that investors are pricing in above-average risks or muted growth, or it may point to a potential mispricing.

Simply Wall St’s proprietary “Fair Ratio” takes valuation one step further by combining the company’s forecast earnings growth, profit margins, industry trends, market cap, and risk profile. This makes it a more precise benchmark for Exor than simple peer or industry comparisons. For Exor, the Fair Ratio is 3.98x. Because the current PE of 1.19x is notably lower than this, the shares appear undervalued by this metric, suggesting the market may not be fully appreciating Exor’s true strengths and prospects.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Exor Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative lets you build your own story behind the numbers, combining your expectations for Exor’s future growth, profit margins, and fair value into a dynamic forecast. By connecting the company’s journey with hard financial estimates, Narratives turn your perspective into an actionable investment view that is clear and easy to follow.

On Simply Wall St’s Community page, used by millions of investors, Narratives empower you to quickly see how your personal fair value compares to Exor’s current share price and decide whether to buy or sell. These forecasts automatically update when new events, news, or earnings releases happen, ensuring your investment decisions stay current. For example, some Exor investors believe the company is worth as little as €70 per share, while others, taking a more optimistic view, set their fair value above €200. Narratives make it simple to explore these perspectives and find the story and price that best fits your own viewpoint.

Do you think there's more to the story for Exor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:EXO

Exor

Engages in the automotive, agriculture and construction, sports car, commercial vehicle, and powertrain businesses worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives