- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

Investors in Basic-Fit (AMS:BFIT) have seen respectable returns of 62% over the past three years

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the Basic-Fit N.V. (AMS:BFIT) share price is up 62% in the last three years, clearly besting the market return of around 36% (not including dividends).

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for Basic-Fit

SWOT Analysis for Basic-Fit

- Debt is well covered by cash flow.

- Interest payments on debt are not well covered.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Current share price is below our estimate of fair value.

- No apparent threats visible for BFIT.

Given that Basic-Fit didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Basic-Fit saw its revenue grow at 17% per year. That's pretty nice growth. The share price gain of 17% per year shows that the market is paying attention to this growth. Of course, valuation is quite sensitive to the rate of growth. Of course, it's always worth considering funding risks when a company isn't profitable.

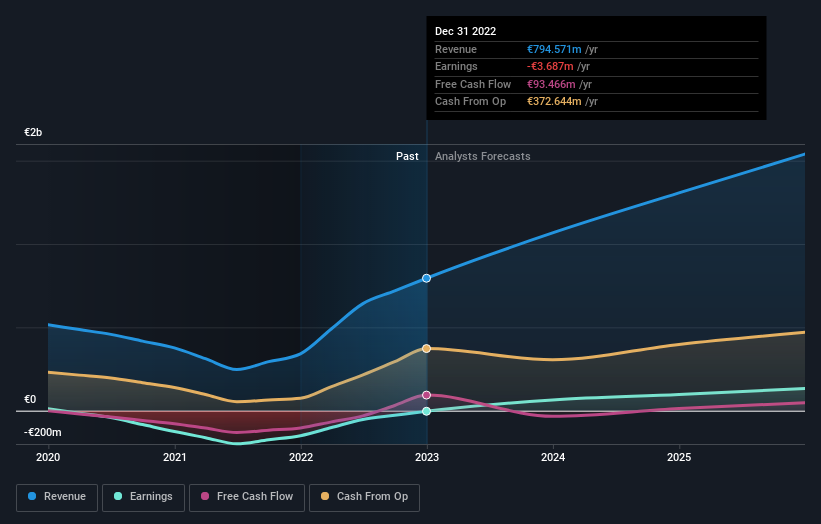

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Basic-Fit in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 10% in the last year, Basic-Fit shareholders lost 7.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Basic-Fit is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:BFIT

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives