- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

European Stocks Estimated To Be Trading Below Their Intrinsic Value In September 2025

Reviewed by Simply Wall St

As September 2025 unfolds, European markets are buoyed by expectations of a U.S. Federal Reserve rate cut, with major indexes like the STOXX Europe 600 Index experiencing gains amid a steady economic outlook from the European Central Bank. In this environment, identifying stocks that are trading below their intrinsic value becomes crucial for investors seeking opportunities in an evolving landscape where careful analysis and strategic positioning can uncover potential value plays.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.71 | €7.22 | 48.6% |

| Rheinmetall (XTRA:RHM) | €1919.50 | €3817.79 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.17 | 49% |

| Green Oleo (BIT:GRN) | €0.78 | €1.52 | 48.6% |

| Gofore Oyj (HLSE:GOFORE) | €14.88 | €29.58 | 49.7% |

| DSV (CPSE:DSV) | DKK1378.00 | DKK2699.19 | 48.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.81 | 49.9% |

| cyan (XTRA:CYR) | €2.24 | €4.41 | 49.2% |

| Brockhaus Technologies (XTRA:BKHT) | €9.86 | €19.22 | 48.7% |

| ATON Green Storage (BIT:ATON) | €2.07 | €4.09 | 49.4% |

Let's dive into some prime choices out of the screener.

Global Dominion Access (BME:DOM)

Overview: Global Dominion Access, S.A. offers comprehensive services aimed at enhancing business process efficiency and sustainability on a global scale, with a market cap of €503.89 million.

Operations: Global Dominion Access, S.A. generates revenue through its integral services focused on improving efficiency and sustainability across various business processes worldwide.

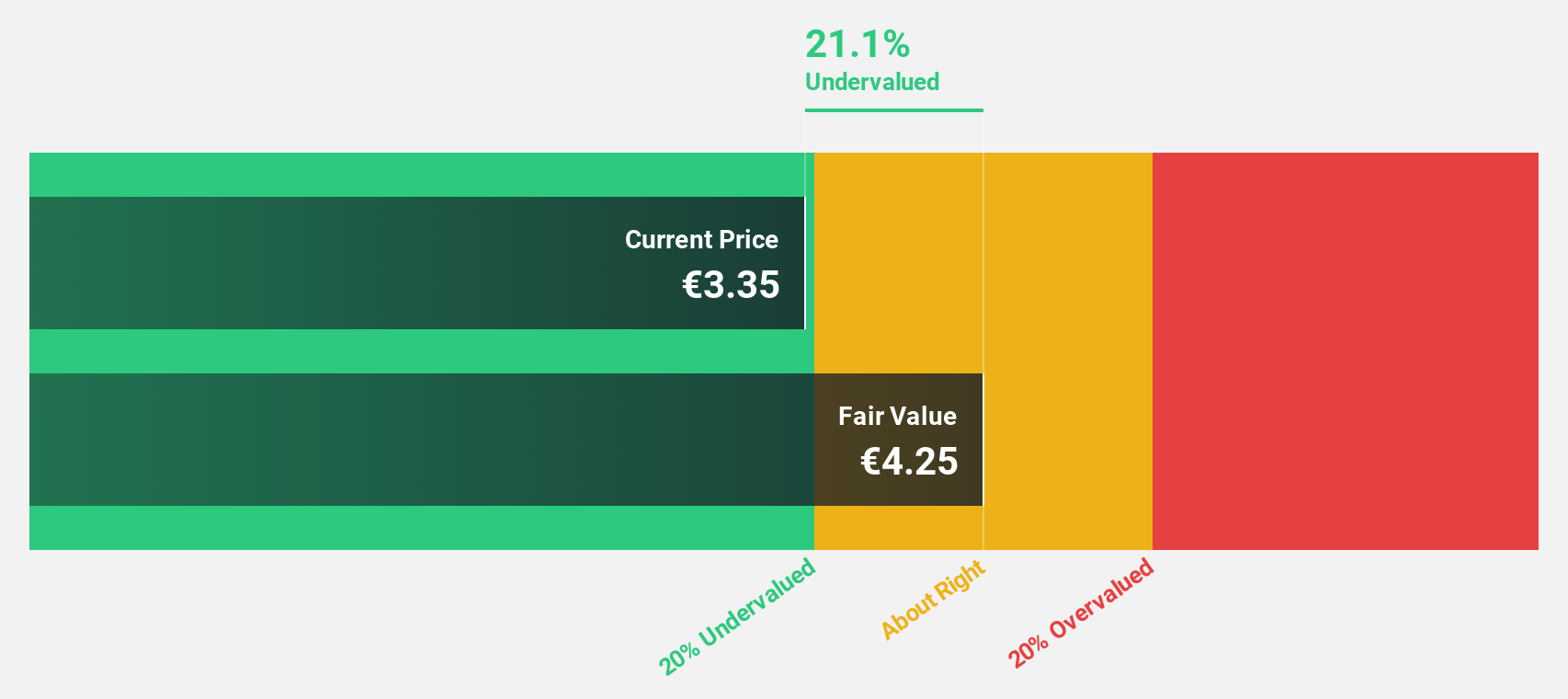

Estimated Discount To Fair Value: 21.3%

Global Dominion Access is trading 21.3% below its estimated fair value of €4.27, presenting potential undervaluation based on cash flows. However, the company's recent earnings report showed a decline in sales and net income compared to the previous year, raising concerns about financial stability. Despite this, DOM's earnings are forecast to grow significantly at 27.4% annually over the next three years, outpacing the Spanish market's growth rate of 4.9%.

- Insights from our recent growth report point to a promising forecast for Global Dominion Access' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Global Dominion Access.

Basic-Fit (ENXTAM:BFIT)

Overview: Basic-Fit N.V., with a market cap of €1.70 billion, operates fitness clubs through its subsidiaries.

Operations: The company's revenue segments include €541.70 million from Benelux and €766 million from France, Spain, and Germany.

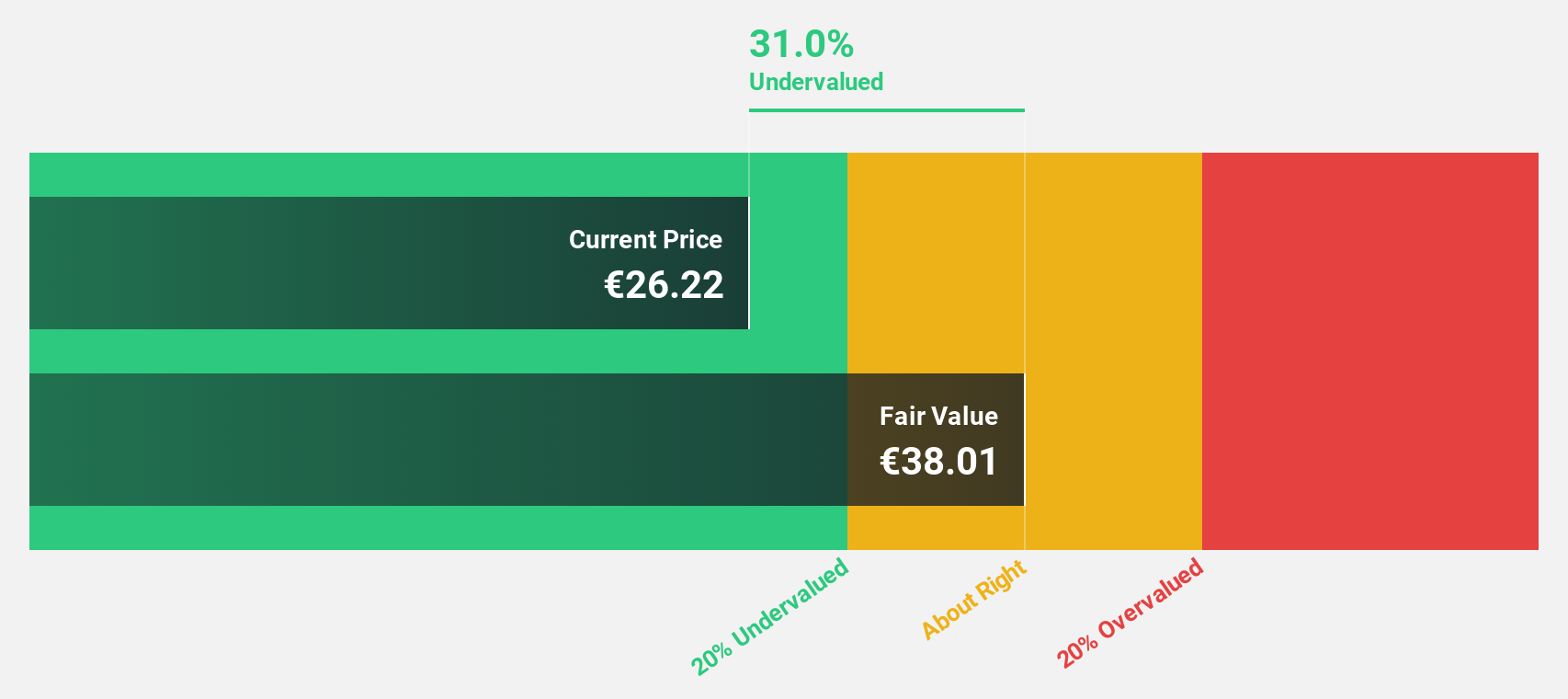

Estimated Discount To Fair Value: 31.7%

Basic-Fit is trading 31.7% below its estimated fair value of €38.01, suggesting potential undervaluation based on cash flows. Despite a net loss of €7.9 million for H1 2025, the company remains on track to meet its full-year revenue guidance between €1.375 billion and €1.425 billion. Revenue growth is forecasted at 9.2% annually, surpassing the Dutch market average, with earnings expected to grow significantly by 45.75% per year over the next three years.

- The analysis detailed in our Basic-Fit growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Basic-Fit stock in this financial health report.

Nagarro (XTRA:NA9)

Overview: Nagarro SE, along with its subsidiaries, offers digital product engineering and technology solutions across Germany, the United States, and other international markets, with a market cap of €645.79 million.

Operations: The company's revenue primarily comes from its Computer Services segment, which generated approximately €988.65 million.

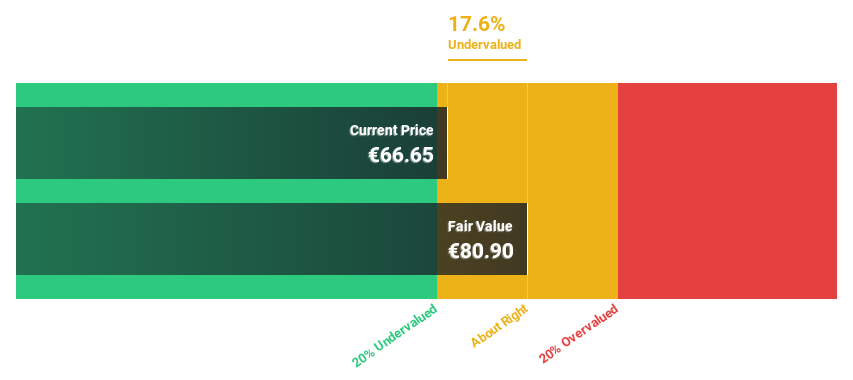

Estimated Discount To Fair Value: 45.1%

Nagarro is trading 45.1% below its estimated fair value of €93.15, indicating potential undervaluation based on cash flows. Despite a decline in net income to €19.57 million for H1 2025, earnings are forecasted to grow significantly at 25.3% annually over the next three years, outpacing the German market average. However, revenue growth is expected to be slower than the market rate and debt levels remain high, presenting some financial risks.

- Upon reviewing our latest growth report, Nagarro's projected financial performance appears quite optimistic.

- Take a closer look at Nagarro's balance sheet health here in our report.

Summing It All Up

- Delve into our full catalog of 210 Undervalued European Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives