- Netherlands

- /

- Consumer Durables

- /

- ENXTAM:PORF

B.V. Delftsch Aardewerkfabriek "De Porceleyne Fles Anno 1653" (AMS:PORF) Is Yielding 5.2% - But Is It A Buy?

Could B.V. Delftsch Aardewerkfabriek "De Porceleyne Fles Anno 1653" (AMS:PORF) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

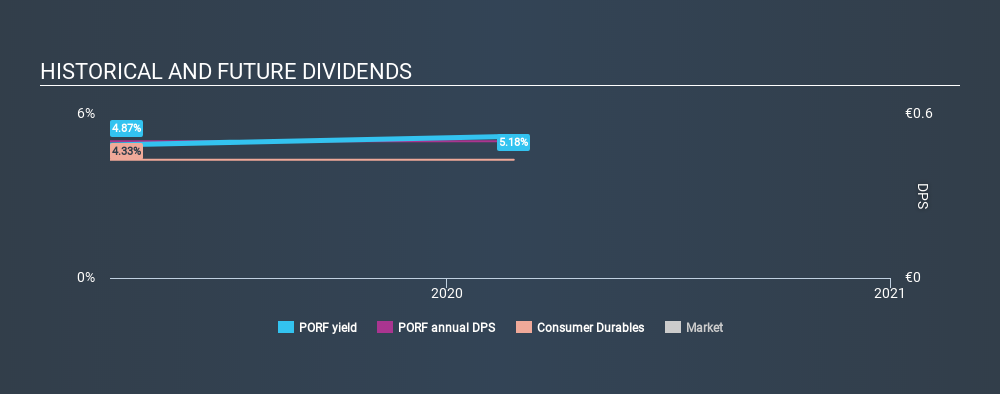

B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 has only been paying a dividend for a year or so, so investors might be curious about its 5.2% yield. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 211% of B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's profits were paid out as dividends in the last 12 months. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's cash payout ratio last year was 3.0%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout. It's good to see that while B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Is B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's Balance Sheet Risky?

As B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). With a net debt to EBITDA ratio of 11.43 times, B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 is very highly levered. While this debt might be serviceable, we would still say it carries substantial risk for the investor who hopes to live on the dividend.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 2.12 times its interest expense, B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's interest cover is starting to look a bit thin. High debt and weak interest cover are not a great combo, and we would be cautious of relying on this company's dividend while these metrics persist.

Remember, you can always get a snapshot of B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was €0.50 per share.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 has grown its earnings per share at 11% per annum over the past five years. With a payout ratio of 211%, B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 is paying out dividends substantially greater than what it earned in profit.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're not keen on the fact that B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 paid out such a high percentage of its income, although its cashflow is in better shape. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. In sum, we find it hard to get excited about B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Are management backing themselves to deliver performance? Check their shareholdings in B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653 in our latest insider ownership analysis.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:PORF

B.V. Delftsch Aardewerkfabriek De Porceleyne Fles Anno 1653

Designs, produces and sells Delft Blue decorative pottery and modern pottery products in the Netherlands.

Proven track record with slight risk.

Market Insights

Community Narratives