- Netherlands

- /

- Professional Services

- /

- ENXTAM:ARCAD

What Arcadis (ENXTAM:ARCAD)'s Exclusive Indigenous Partnership Means for Future Project Opportunities

Reviewed by Simply Wall St

- On August 27, 2025, the Mississaugas of the Credit Business Corporation announced an exclusivity agreement with Arcadis to establish a majority Indigenous-owned partnership delivering design consulting and professional services across the Greater Golden Horseshoe in Ontario.

- This marks Arcadis’ first partnership of its kind, signaling a pioneering step for Indigenous-led infrastructure development in one of Canada’s most important economic regions.

- We’ll examine how exclusive access to sustainable infrastructure projects through this partnership could influence Arcadis’ future business outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Arcadis Investment Narrative Recap

For shareholders, a core belief in Arcadis' ability to win and execute on sustainable infrastructure projects is key. The recent exclusivity agreement with Mississaugas of the Credit Business Corporation signals a potential new avenue for growth in Canada, though its immediate impact appears limited compared to broader business risks such as slowing revenue growth and ongoing margin pressures. The main short-term catalyst remains the conversion of Arcadis' robust project pipeline into higher backlog and tangible earnings momentum, while execution risks from project delays and integration challenges continue to loom.

The March 2025 announcement of a US$1.5 billion ten-year contract with the U.S. Air Force stands out as another major driver, underscoring Arcadis’ positioning in large-scale government and sustainability-related contracts. Both this and the Indigenous partnership carry the promise of boosting long-term project backlog, which could help mitigate near-term volatility from delayed client decisions in infrastructure markets. However, against this backdrop, investors should keep a close eye on how...

Read the full narrative on Arcadis (it's free!)

Arcadis' narrative projects €4.4 billion revenue and €377.0 million earnings by 2028. This requires a 3.8% yearly revenue decline and a €139.0 million earnings increase from €238.0 million currently.

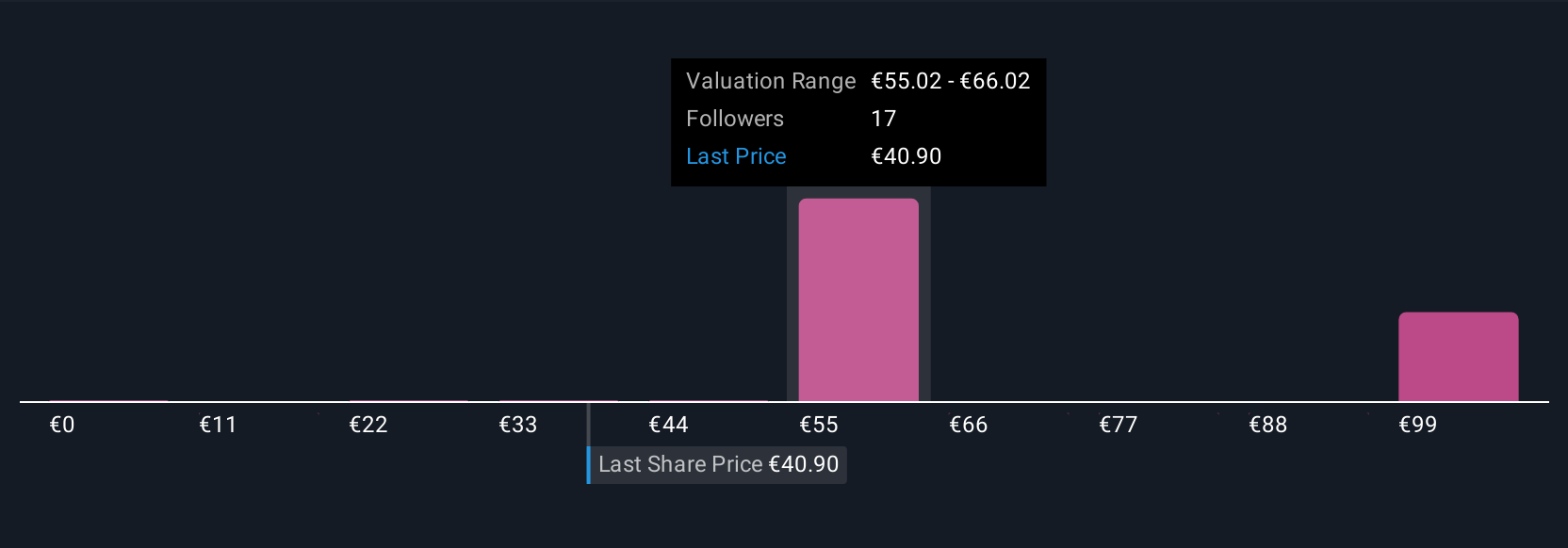

Uncover how Arcadis' forecasts yield a €57.93 fair value, a 50% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span from €10.93 to €109.35, reflecting wide divergence among participants. As you compare these perspectives, consider how current project delays and margin risks may influence future returns.

Explore 6 other fair value estimates on Arcadis - why the stock might be worth over 2x more than the current price!

Build Your Own Arcadis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcadis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arcadis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcadis' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ARCAD

Arcadis

Offers design, engineering, architecture, and consultancy solutions for natural and built assets in The Americas, Europe, the Middle East, and the Asia Pacific.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives