As we move into January 2025, global markets have shown mixed signals with U.S. consumer confidence dipping and key indices like the Nasdaq Composite and Russell 2000 experiencing fluctuations amid economic uncertainties. Despite these challenges, the search for undiscovered gems in the stock market remains a compelling pursuit, as investors look for companies that demonstrate resilience and potential growth even in volatile conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Italian Sea Group (BIT:TISG)

Simply Wall St Value Rating: ★★★★★★

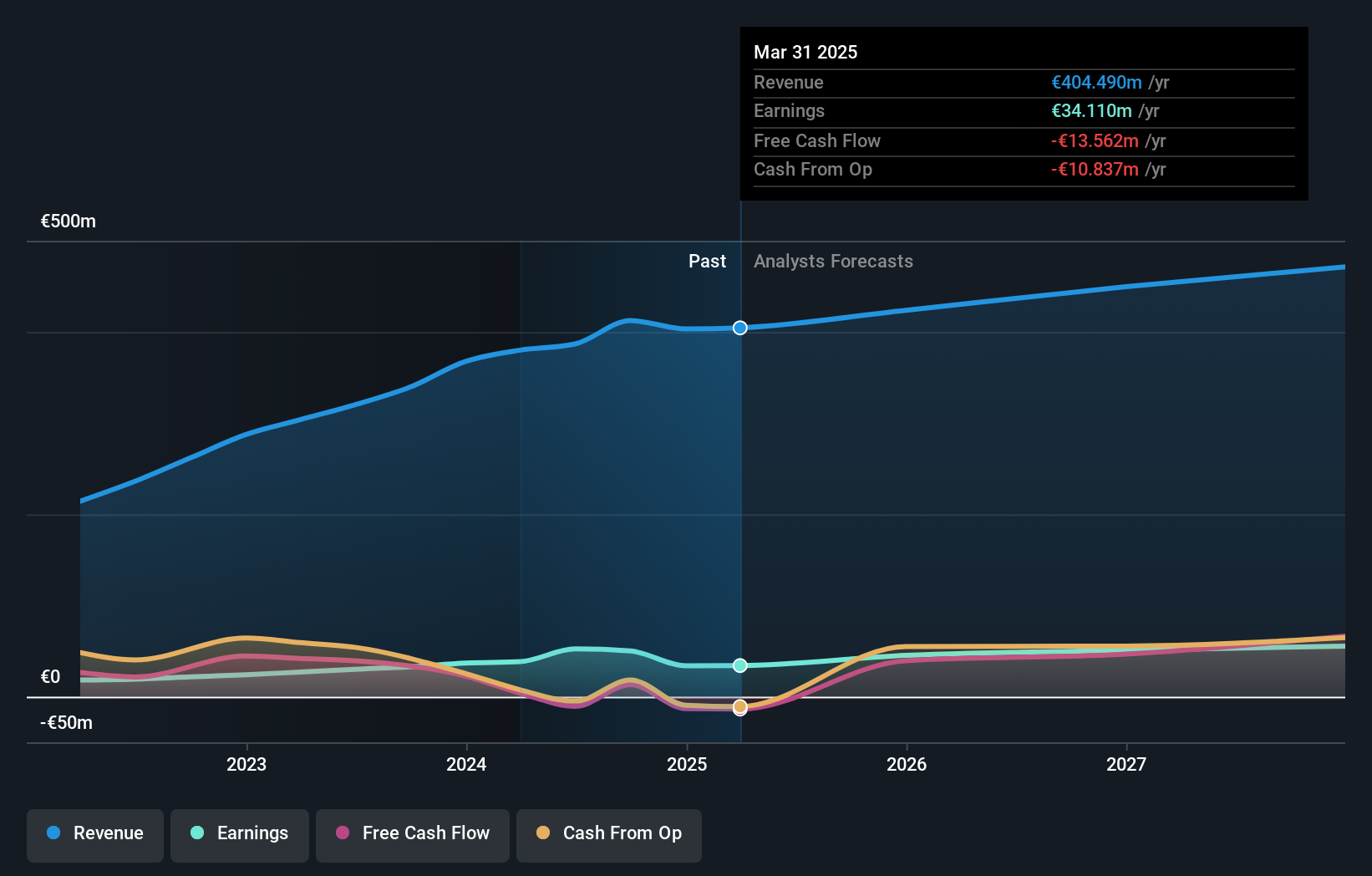

Overview: The Italian Sea Group S.p.A. operates in the luxury yachting industry with a market capitalization of €392.73 million.

Operations: Italian Sea Group generates revenue primarily from shipbuilding (€347.59 million) and refit services (€43.97 million). The company's financial performance is influenced by its focus on these segments, with shipbuilding being the dominant revenue stream.

Italian Sea Group showcases a promising profile with its earnings growth of 52.9% over the past year, significantly outpacing the Leisure industry's 11.3%. Trading at an attractive 54.4% below estimated fair value, it offers good relative value compared to peers. The company's net income for the nine months ended September 2024 reached €37.69 million, up from €24.53 million a year prior, indicating robust performance and profitability that isn't hindered by debt concerns due to its satisfactory net debt to equity ratio of 4.8%. With earnings projected to grow annually by approximately 10%, prospects appear positive for this niche player in luxury yachting.

- Dive into the specifics of Italian Sea Group here with our thorough health report.

Gain insights into Italian Sea Group's past trends and performance with our Past report.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

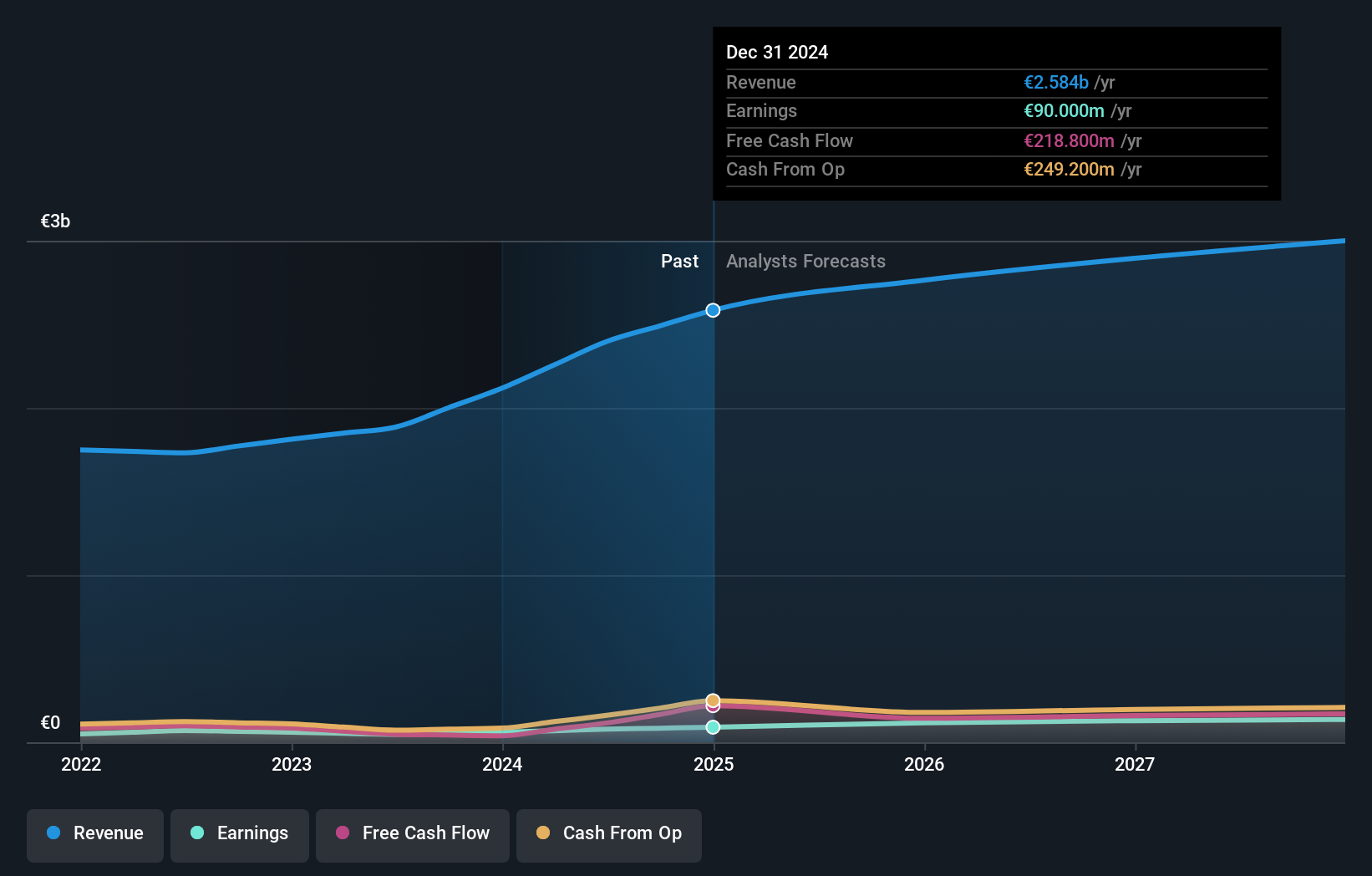

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market capitalization of approximately €846.36 million.

Operations: Heijmans generates revenue primarily from its Connecting segment, amounting to €871.03 million. The Segment Adjustment contributes an additional €1.83 billion to the overall revenue stream.

Heijmans, a smaller player in the construction sector, has shown impressive earnings growth of 65.5% over the past year, outpacing the industry's 6.7%. Trading at a significant discount of 64.8% below its estimated fair value suggests potential upside for investors. The company has effectively reduced its debt to equity ratio from 44.2% to just 10% over five years and maintains strong interest coverage with EBIT covering interest payments by 16.7 times. However, shareholders experienced dilution recently, which may be a point of concern despite high-quality earnings and positive free cash flow trends supporting future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Koninklijke Heijmans.

Assess Koninklijke Heijmans' past performance with our detailed historical performance reports.

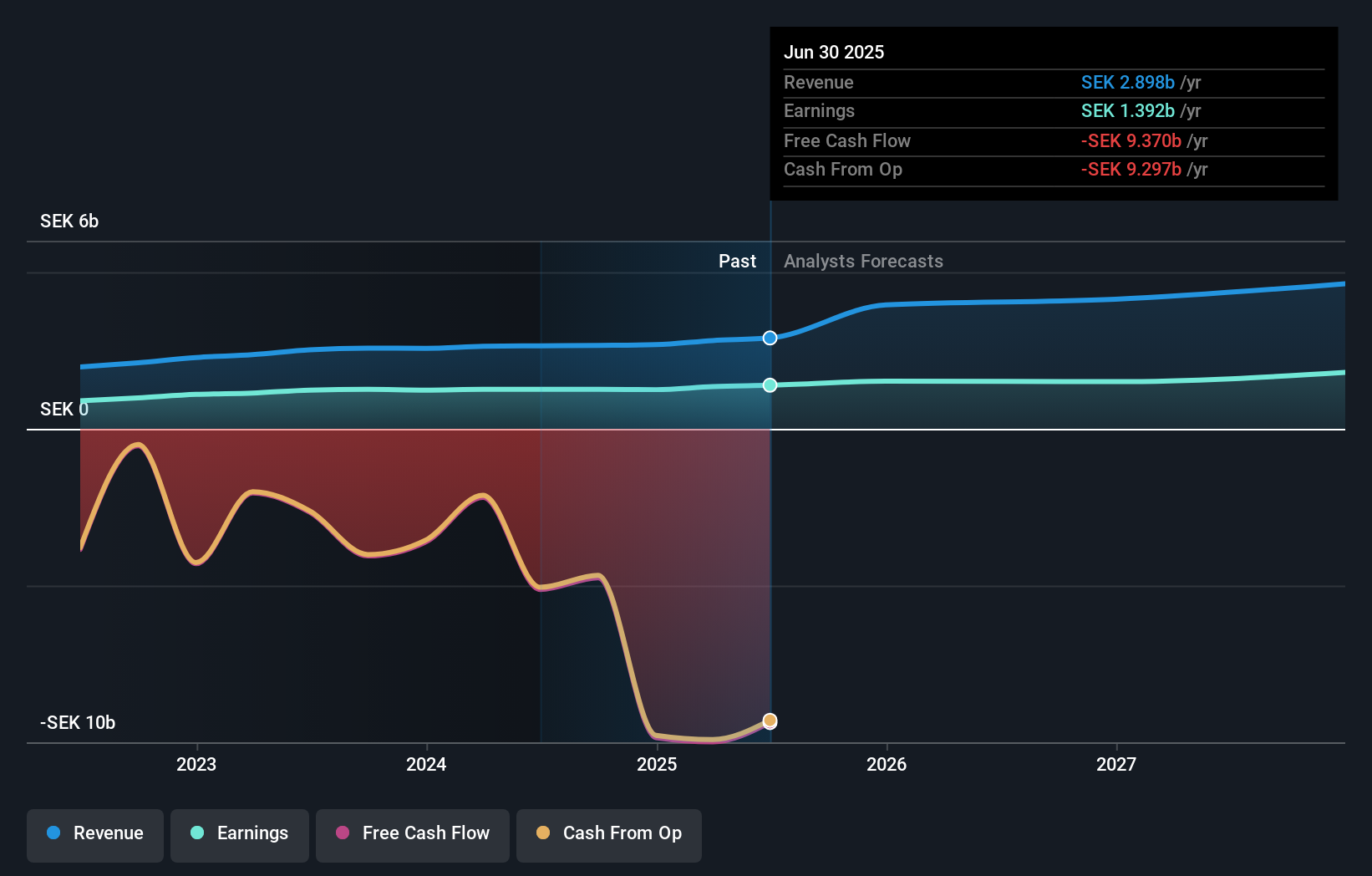

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norion Bank AB (publ) offers financial solutions for corporate and private individuals, emphasizing services for small and medium-sized companies across Sweden, Finland, Norway, and internationally, with a market cap of approximately SEK7.48 billion.

Operations: Norion Bank generates revenue primarily from its Real Estate, Consumer, and Corporate segments, with Real Estate contributing SEK1.21 billion. The Payments segment adds SEK496 million to the revenue stream.

With assets totaling SEK59.3 billion and equity at SEK8.8 billion, Norion Bank stands as a notable player in the financial sector, though it grapples with a high bad loan ratio of 21.8%. Despite this challenge, its funding sources are primarily low risk, with customer deposits comprising 91% of liabilities. The bank's earnings grew by a modest 0.2% over the past year but outpaced the industry average of 0.2%. Trading significantly below estimated fair value by 76.7%, Norion offers potential upside for those seeking undervalued opportunities within the banking space while maintaining high-quality earnings standards.

- Delve into the full analysis health report here for a deeper understanding of Norion Bank.

Understand Norion Bank's track record by examining our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 4638 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TISG

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives