- Netherlands

- /

- Construction

- /

- ENXTAM:FUR

European Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As European markets navigate a landscape marked by mixed performances and cautious monetary policy adjustments, the pan-European STOXX Europe 600 Index has shown resilience with a fourth consecutive week of gains amid hopes for easing trade tensions. In this context, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration in times of economic uncertainty.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.33% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.55% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.43% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.80% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.52% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.70% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

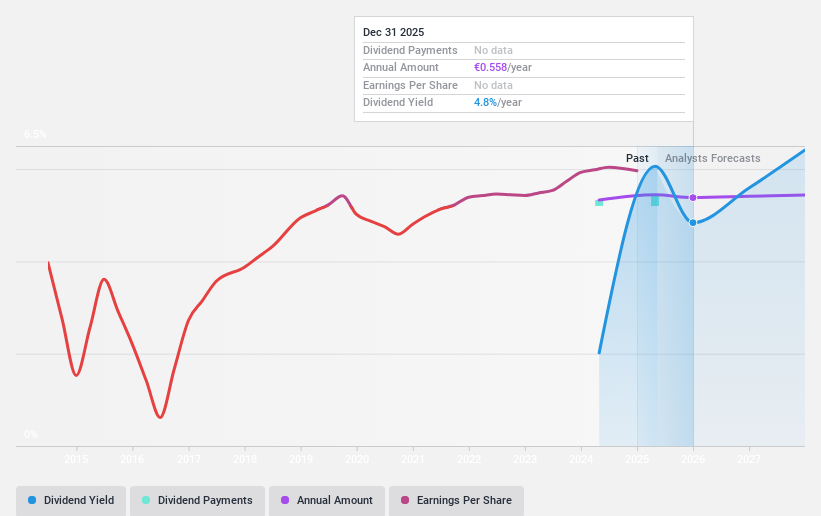

Fugro (ENXTAM:FUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fugro N.V. offers geo-data services for the infrastructure, energy, and water sectors across various regions including Europe, Africa, the Americas, Asia Pacific, the Middle East, and India with a market cap of €1.22 billion.

Operations: Fugro N.V.'s revenue is generated from its operations in different regions, with €515.72 million from the Americas, €488.97 million from Asia Pacific, €1.11 billion from Europe-Africa, and €225.45 million from the Middle East & India.

Dividend Yield: 6.8%

Fugro's recent initiation of a €0.75 annual dividend per share marks its entry into the dividend-paying segment, with payments covered by both earnings and cash flows, indicated by payout ratios of 32% and 57.8%, respectively. While the dividend yield is competitive within the Dutch market's top quartile, significant insider selling raises caution. The company's financial performance has shown growth, but it's too early to assess long-term reliability or stability of these dividends.

- Dive into the specifics of Fugro here with our thorough dividend report.

- According our valuation report, there's an indication that Fugro's share price might be on the cheaper side.

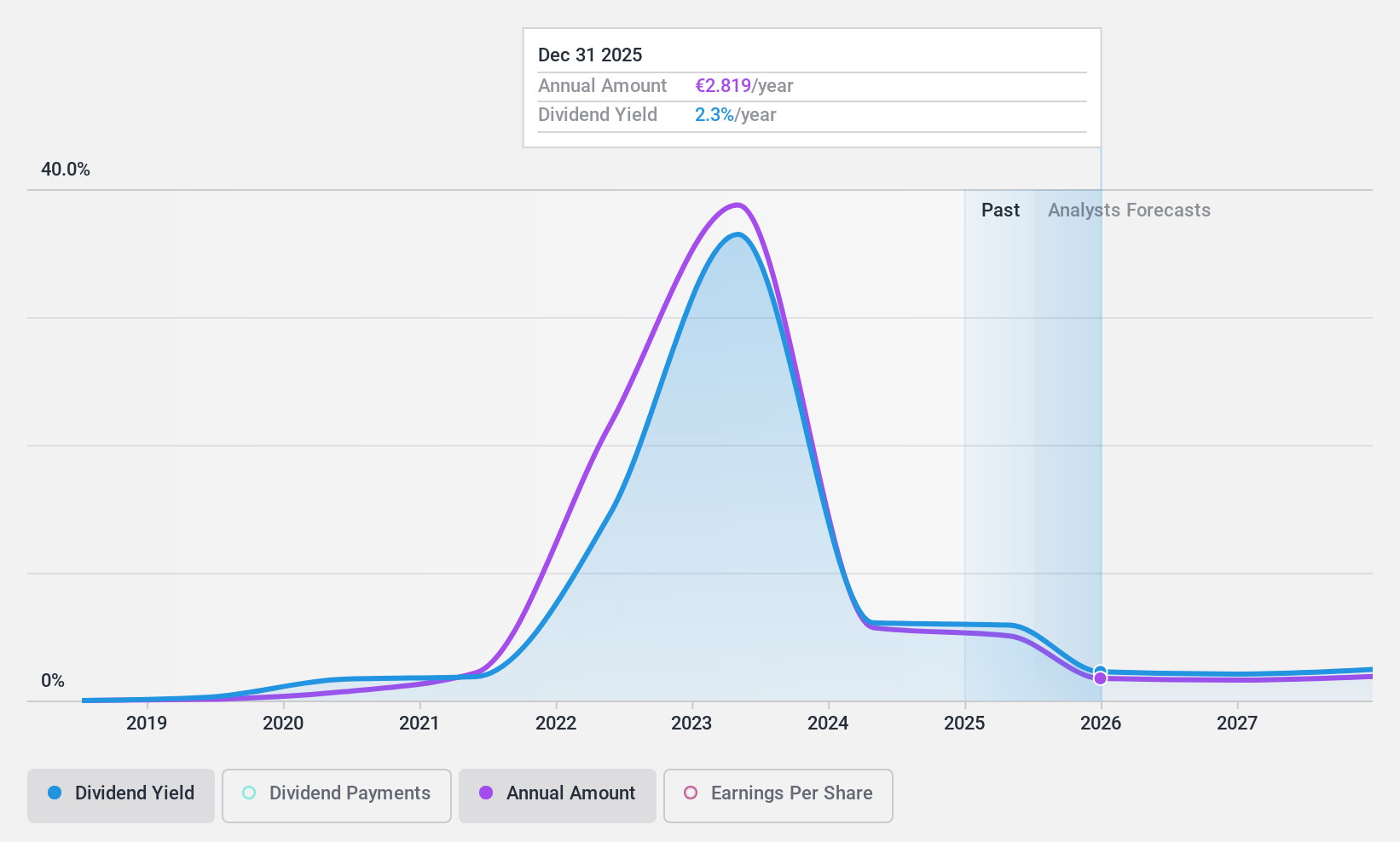

Hapag-Lloyd (XTRA:HLAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hapag-Lloyd Aktiengesellschaft, along with its subsidiaries, operates as a global liner shipping company and has a market cap of €25.75 billion.

Operations: Hapag-Lloyd generates its revenue primarily from Liner Shipping (€18.75 billion) and Terminal & Infrastructure (€401.10 million) segments.

Dividend Yield: 5.6%

Hapag-Lloyd's dividend, though in the top 25% of German payers with a 5.6% yield, has been volatile over its six-year history. The recent announcement of an €8.20 per share dividend marks a decrease and reflects instability in payouts despite being covered by earnings (60.4%) and cash flows (65.6%). With projected earnings decline and lower net income year-on-year, the sustainability of future dividends may be under pressure.

- Get an in-depth perspective on Hapag-Lloyd's performance by reading our dividend report here.

- The analysis detailed in our Hapag-Lloyd valuation report hints at an inflated share price compared to its estimated value.

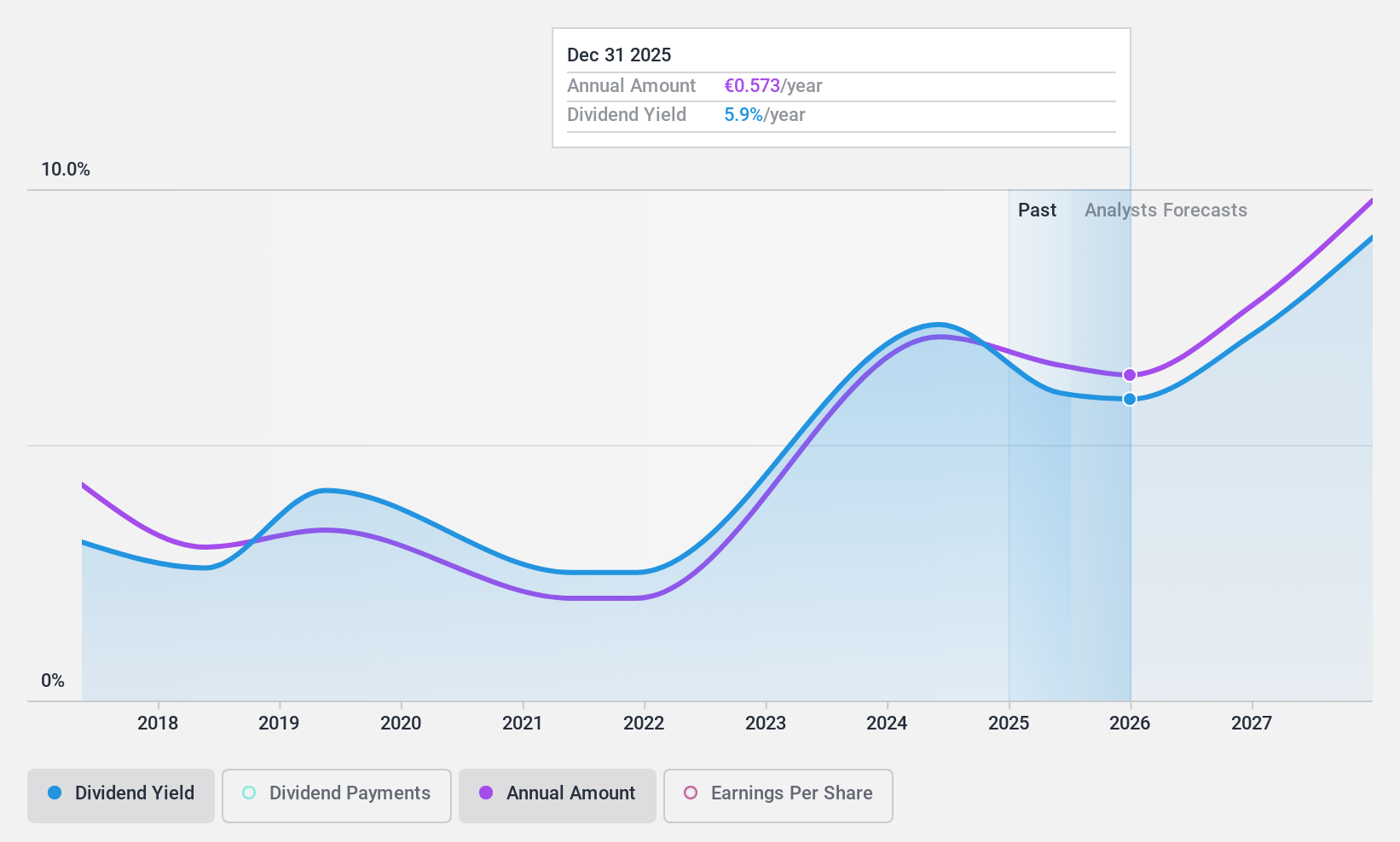

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, along with its subsidiaries, offers commercial banking products and services to small and medium enterprises and private customers across Europe, South America, and Germany, with a market cap of €668.50 million.

Operations: ProCredit Holding AG generates its revenue through providing commercial banking services to small and medium enterprises as well as private customers in Europe, South America, and Germany.

Dividend Yield: 5.2%

ProCredit Holding offers a dividend yield of 5.2%, placing it in the top 25% of German market payers, yet its dividend history is unstable with recent decreases. Despite a low payout ratio (33.3%) ensuring coverage by earnings, and forecasted sustainability (40.4% in three years), the company's high level of non-performing loans (2.3%) and declining net income—EUR 25.2 million for Q1 2025—raise concerns about future reliability.

- Click to explore a detailed breakdown of our findings in ProCredit Holding's dividend report.

- Our valuation report unveils the possibility ProCredit Holding's shares may be trading at a discount.

Make It Happen

- Take a closer look at our Top European Dividend Stocks list of 231 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:FUR

Fugro

Provides geo-data services for the infrastructure, energy, and water industries in Europe, Africa, the Americas, the Asia Pacific, the Middle East, and India.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives