- Netherlands

- /

- Construction

- /

- ENXTAM:BOKA

Royal Boskalis Westminster's (AMS:BOKA) Stock Price Has Reduced 48% In The Past Five Years

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Royal Boskalis Westminster N.V. (AMS:BOKA), since the last five years saw the share price fall 48%. On top of that, the share price is down 8.0% in the last week.

See our latest analysis for Royal Boskalis Westminster

Because Royal Boskalis Westminster made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Royal Boskalis Westminster saw its revenue shrink by 3.6% per year. That's not what investors generally want to see. The share price decline at a rate of 8% per year is disappointing. Unfortunately, though, it makes sense given the lack of either profits or revenue growth. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

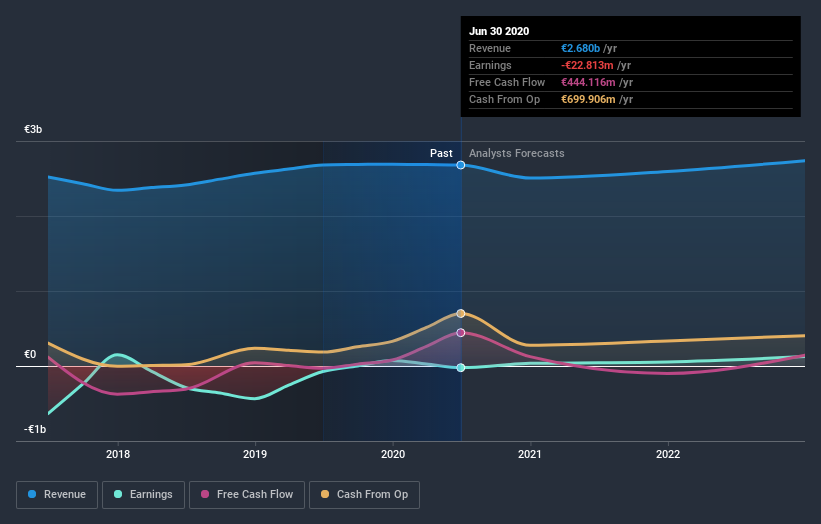

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Royal Boskalis Westminster's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Royal Boskalis Westminster's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Royal Boskalis Westminster shareholders, and that cash payout explains why its total shareholder loss of 40%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Royal Boskalis Westminster shareholders are down 18% for the year, but the market itself is up 1.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

If you’re looking to trade Royal Boskalis Westminster, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTAM:BOKA

Royal Boskalis Westminster

Royal Boskalis Westminster N.V. provides dredging, offshore energy, and maritime services worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives