The European stock market has experienced a mixed performance recently, with the STOXX Europe 600 Index snapping a streak of gains amid uncertainties surrounding U.S. trade policies. However, potential increases in defense and infrastructure spending by Germany and the EU have provided some support to investor sentiment. In this context, dividend stocks can offer a measure of stability and income for investors seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.34% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.21% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.99% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.95% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.80% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.18% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.36% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.16% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

HOMAG Group (DB:HG1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HOMAG Group AG, along with its subsidiaries, manufactures and sells machines and solutions for the woodworking and timber construction industries globally, with a market cap of €454.95 million.

Operations: The HOMAG Group generates revenue from manufacturing and selling machines and solutions tailored for the woodworking and timber construction sectors worldwide.

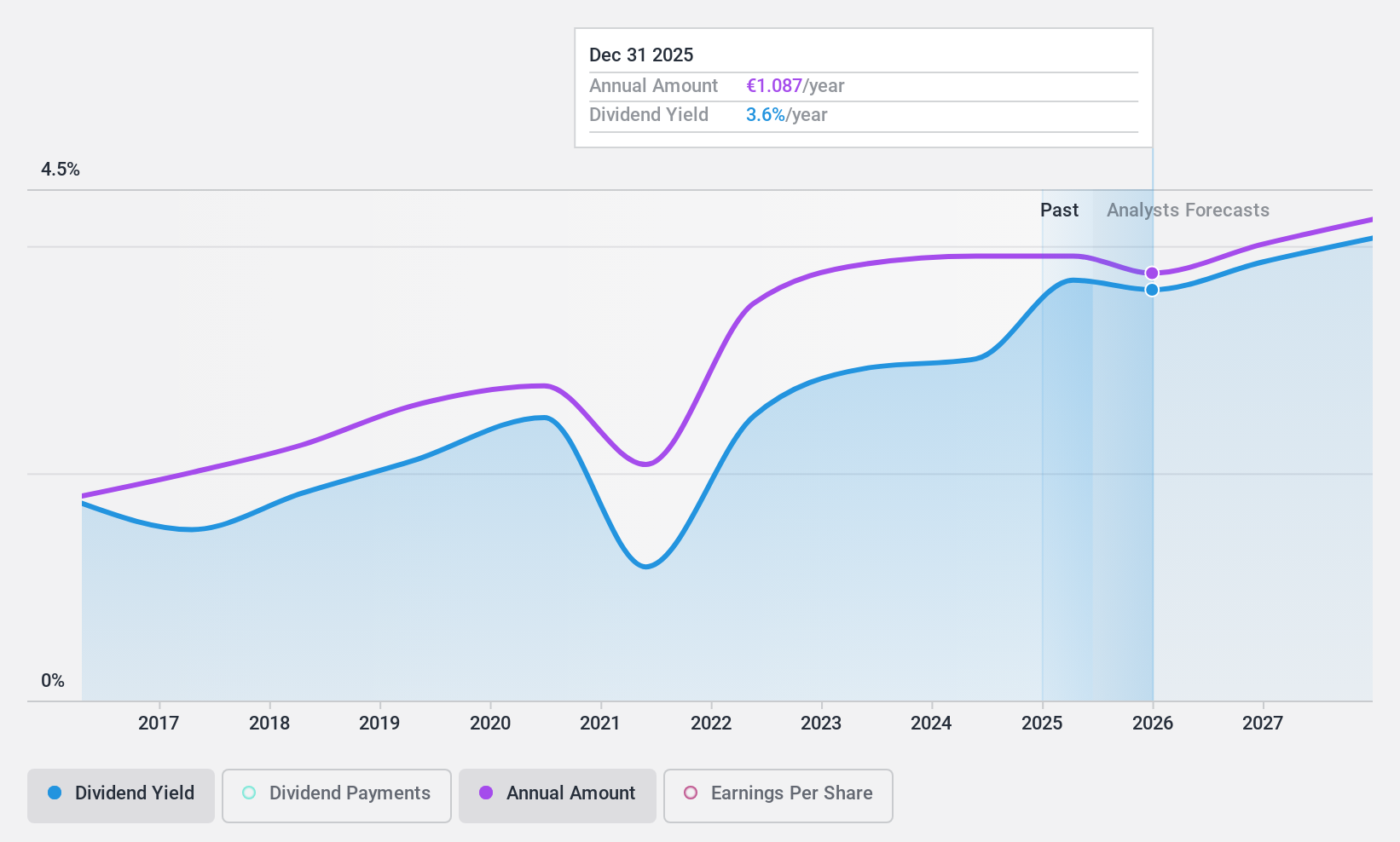

Dividend Yield: 3.6%

HOMAG Group offers a stable dividend profile with a low payout ratio of 31.5%, indicating dividends are well covered by earnings. The company has maintained reliable and growing dividends over the past decade, although its 3.58% yield is below the top tier in Germany. Despite recent share price volatility and outdated financial reports, its attractive price-to-earnings ratio of 8.8x suggests potential value compared to the broader market's 17x average.

- Take a closer look at HOMAG Group's potential here in our dividend report.

- Our valuation report here indicates HOMAG Group may be overvalued.

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V., along with its subsidiaries, provides essential technologies for the building, industrial, and semiconductor sectors across Europe, the United States, the Asia Pacific, the Middle East, and Africa with a market cap of approximately €37 billion.

Operations: Aalberts N.V. generates its revenue from three primary segments: Semicon (€501.30 million), Building Technology (€1.60 billion), and Industrial Technology (€1.06 billion).

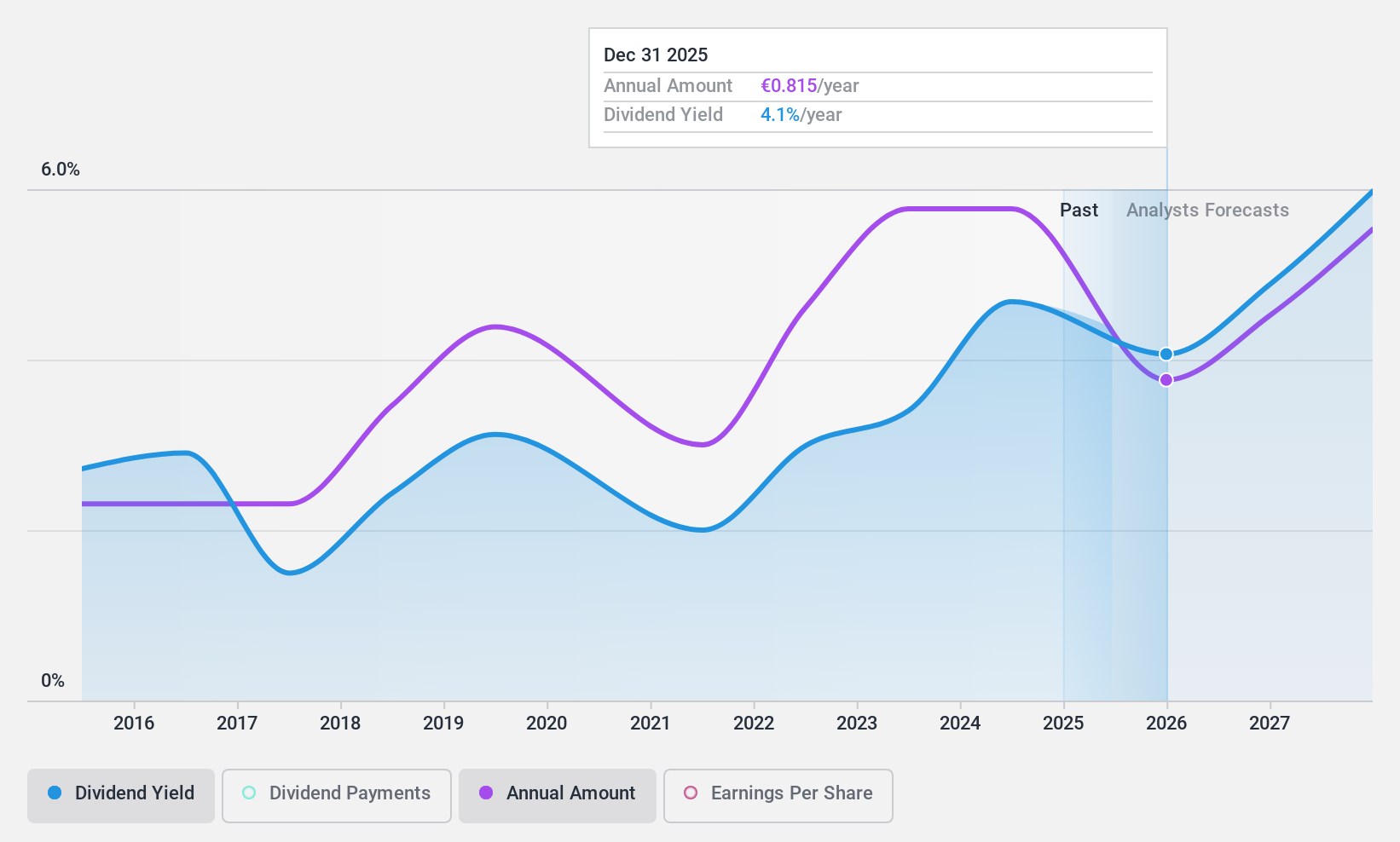

Dividend Yield: 3.4%

Aalberts' dividend payments have grown over the past decade but remain volatile and unreliable, with a payout ratio of 69.8% indicating coverage by earnings. The dividend yield of 3.38% is below the top tier in the Dutch market. Recent announcements include a €75 million share buyback program aimed at enhancing shareholder value, despite challenging market conditions leading to flat revenue expectations and an improved EBITA margin for 2025.

- Unlock comprehensive insights into our analysis of Aalberts stock in this dividend report.

- Our valuation report unveils the possibility Aalberts' shares may be trading at a discount.

Mersen (ENXTPA:MRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mersen S.A. is a company that manufactures and sells electrical power products and advanced materials across various regions including France, North America, Europe, and the Asia-Pacific, with a market cap of €539.56 million.

Operations: Mersen S.A.'s revenue is derived from two main segments: Electrical Power, contributing €545.50 million, and Advanced Materials, generating €681.70 million.

Dividend Yield: 5.6%

Mersen offers a high dividend yield of 5.64%, placing it among the top 25% of French dividend payers, yet its dividends have been unreliable and volatile over the past decade. Despite trading at 49.2% below estimated fair value, Mersen's dividends are not well covered by free cash flows, though they are supported by a low payout ratio of 39.5%. The company's earnings have grown significantly but recent share price volatility may concern investors seeking stability.

- Delve into the full analysis dividend report here for a deeper understanding of Mersen.

- Upon reviewing our latest valuation report, Mersen's share price might be too pessimistic.

Seize The Opportunity

- Explore the 235 names from our Top European Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade HOMAG Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HOMAG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:HG1

HOMAG Group

Manufactures and sells machines and solutions for woodworking and timber construction industries worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives