- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

Does ING’s Surging 44.7% Rally Signal More Strength After Strong Q1 Earnings?

Reviewed by Bailey Pemberton

Trying to decide what to do next with ING Groep stock? You are not alone. With so much buzz surrounding global financials right now, ING Groep’s share price has been anything but dull. Take a look at the numbers: the stock has run up 7.5% over the past month, and since the start of the year it is up a stunning 44.7%. Go back just a bit further and you will find 49.0% growth over the past year, and a staggering 367.4% over the last five years. These are not just small bumps; they are major moves that tend to capture investors’ attention for a reason.

A lot of this momentum reflects shifts in the broader market landscape. Banking stocks like ING Groep have experienced cycles of risk-off and risk-on sentiment as investors navigate changes in interest rates and the global economic outlook. Recent gains seem to price in both ING Groep’s steady performance as a leading European bank and a growing sense that the sector could be safer than previously assumed, not to mention attractive in terms of dividends and stability.

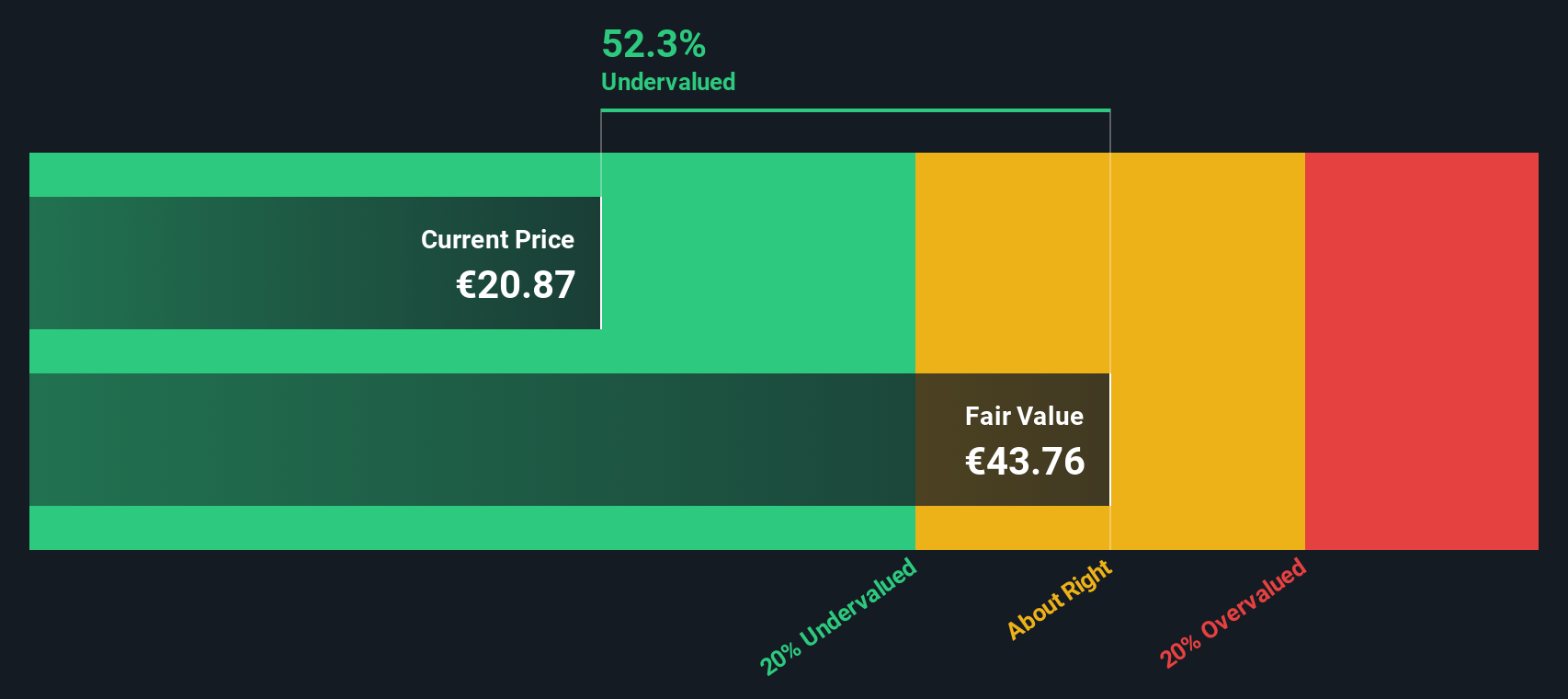

Of course, the numbers only tell part of the story. When it comes to deciding whether the stock still looks like a smart buy, valuation is key. According to our scoring system, ING Groep scores a 3 out of 6 on undervaluation, meaning it is undervalued in half of the areas we look at. But how do these checks really stack up? In the next section, we will break down the different valuation approaches, and at the end we will share a more insightful way to see if ING Groep is truly a bargain right now.

Why ING Groep is lagging behind its peers

Approach 1: ING Groep Excess Returns Analysis

The Excess Returns valuation model evaluates ING Groep’s ability to generate profits above its cost of equity, focusing on how much value is added for shareholders relative to the capital invested. This approach highlights the importance of consistently delivering returns on equity that outpace funding costs, ensuring that growth creates real, sustainable value.

According to analyst projections, ING Groep has a Book Value of €17.36 per share and a Stable EPS (earnings per share) of €2.31. These future estimates are based on the collective outlook of 13 analysts regarding the company’s capacity for generating profits. The Cost of Equity is estimated at €1.11 per share, while the Excess Return, the surplus over the cost of capital, is €1.20 per share. The bank’s Average Return on Equity stands at 13.13%, with a Stable Book Value per share projected at €17.61 (as derived from 9 analysts).

Based on this analysis, the model calculates an intrinsic valuation that implies the stock is trading at a 49.4% discount to its fair value. This substantial margin suggests ING Groep shares are meaningfully undervalued relative to the returns they are expected to generate for investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests ING Groep is undervalued by 49.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ING Groep Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing established, profitable companies like ING Groep. It offers a simple way to express what investors are willing to pay for each euro of earnings. This makes it ideal for banks where profits are typically more stable and transparent compared to newer or rapidly evolving industries.

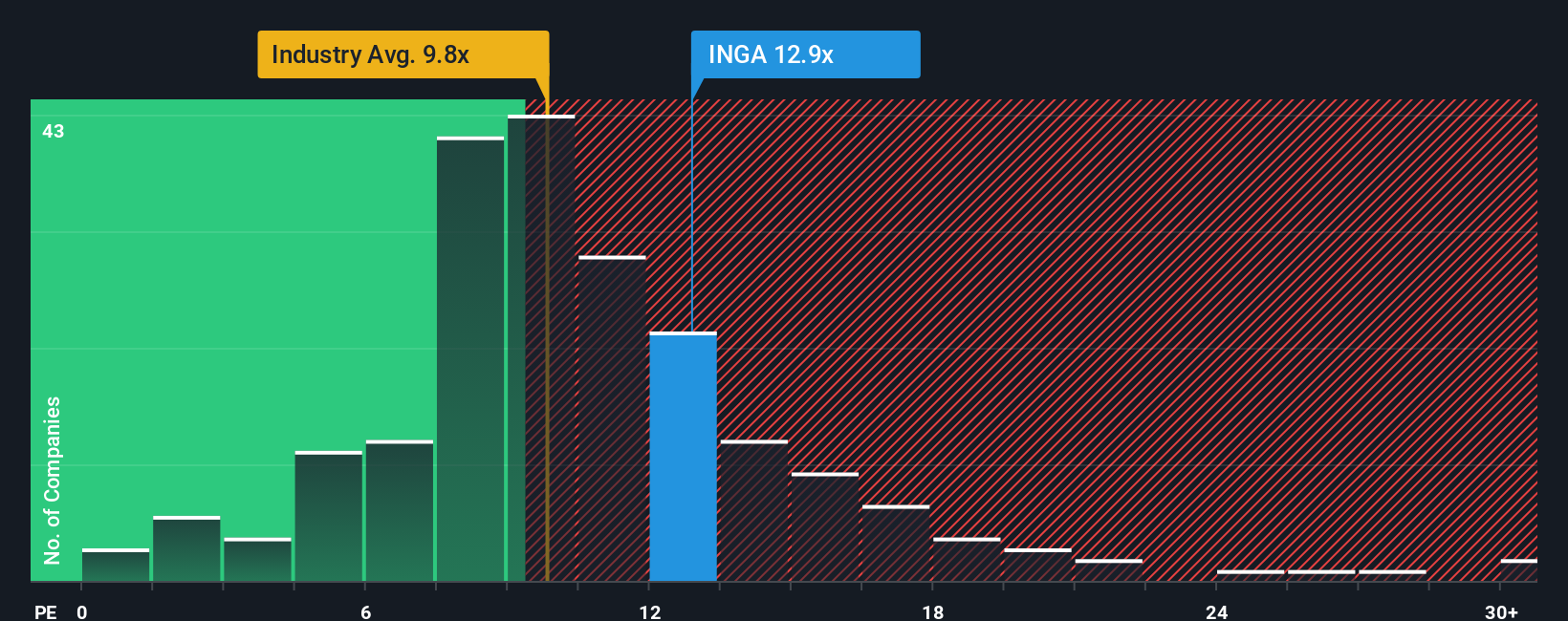

Growth expectations and risk profiles play a big role in shaping what is considered a “normal” or “fair” PE ratio. Higher growth companies or those with lower risk typically warrant a higher PE, while slower growth or riskier names command a discount. For ING Groep, the current PE ratio stands at 12.88x. In comparison, the average for its direct peers is 9.61x, and the broader European banking industry sits at 10.33x. At first glance, ING Groep trades above these typical benchmarks, hinting at a premium relative to its sector.

This is where Simply Wall St’s “Fair Ratio” concept adds value. Unlike a simple peer or industry average, the Fair Ratio is calculated here at 12.96x and factors in ING Groep’s specific growth profile, risk, profit margins, industry, and market cap. This approach is more tailored and paints a fuller picture of the stock’s true value. Comparing ING Groep’s actual PE ratio of 12.88x with the Fair Ratio of 12.96x, the valuation difference is minimal. This suggests the share price closely reflects the company’s underlying fundamentals at present.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ING Groep Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce Narratives, a smarter and more dynamic way to invest that goes beyond the usual ratios and financial models. A Narrative is essentially your story about a company. It lets you combine your personal perspective on ING Groep’s future with assumptions for fair value, predicted revenue, earnings, and profit margins. This approach transforms the numbers into a living financial forecast, directly linking ING Groep’s story to real fair value estimates so your investment decisions are guided by both data and belief.

Narratives are accessible, easy to use, and available now to millions via the Simply Wall St Community page. They help you decide when to buy or sell by comparing your view of fair value to the current price. Because Narratives update as soon as new news or results arrive, your insights stay relevant. For example, some investors currently estimate a fair value for ING Groep as high as €27.92, while others see it as low as €17.50, based on their differing outlooks for digital banking growth, regulation, or earnings potential. With Narratives, you can join the conversation, test your own thesis, and see exactly how new information changes your investment story in real time.

Do you think there's more to the story for ING Groep? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives