- Malaysia

- /

- Infrastructure

- /

- KLSE:LITRAK

Is Lingkaran Trans Kota Holdings Berhad (KLSE:LITRAK) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Lingkaran Trans Kota Holdings Berhad (KLSE:LITRAK) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Lingkaran Trans Kota Holdings Berhad

What Is Lingkaran Trans Kota Holdings Berhad's Debt?

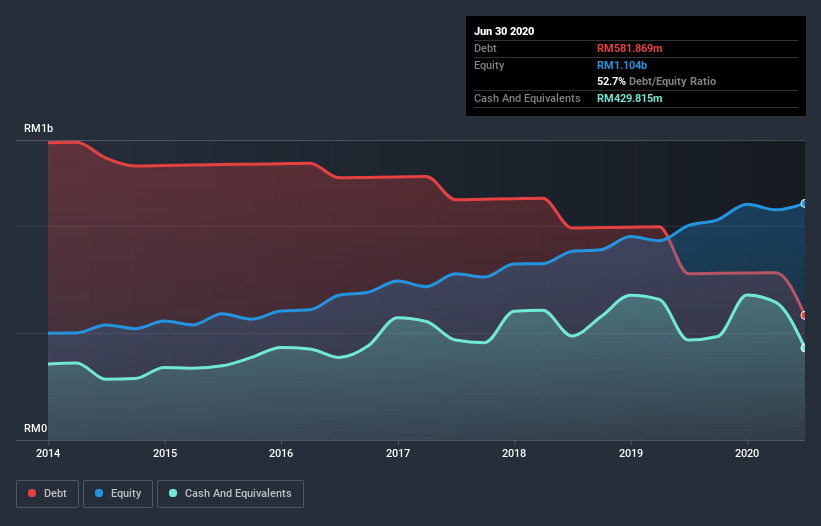

You can click the graphic below for the historical numbers, but it shows that Lingkaran Trans Kota Holdings Berhad had RM581.9m of debt in June 2020, down from RM776.3m, one year before. However, it does have RM429.8m in cash offsetting this, leading to net debt of about RM152.1m.

How Healthy Is Lingkaran Trans Kota Holdings Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Lingkaran Trans Kota Holdings Berhad had liabilities of RM222.7m due within 12 months and liabilities of RM603.6m due beyond that. On the other hand, it had cash of RM429.8m and RM152.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM243.9m.

Since publicly traded Lingkaran Trans Kota Holdings Berhad shares are worth a total of RM2.13b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Lingkaran Trans Kota Holdings Berhad's net debt is only 0.38 times its EBITDA. And its EBIT covers its interest expense a whopping 10.1 times over. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Lingkaran Trans Kota Holdings Berhad's EBIT dived 15%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Lingkaran Trans Kota Holdings Berhad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Lingkaran Trans Kota Holdings Berhad recorded free cash flow worth a fulsome 95% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Lingkaran Trans Kota Holdings Berhad's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But we must concede we find its EBIT growth rate has the opposite effect. We would also note that Infrastructure industry companies like Lingkaran Trans Kota Holdings Berhad commonly do use debt without problems. When we consider the range of factors above, it looks like Lingkaran Trans Kota Holdings Berhad is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Lingkaran Trans Kota Holdings Berhad has 2 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Lingkaran Trans Kota Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:LITRAK

Lingkaran Trans Kota Holdings Berhad

Lingkaran Trans Kota Holdings Berhad, an investment holding company, engages in the design, construction, operation, management, and maintenance of Lebuhraya Damansara- Puchong and Western Kuala Lumpur Traffic Dispersal Scheme highway in Malaysia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives