- Malaysia

- /

- Infrastructure

- /

- KLSE:AIRPORT

Investors Appear Satisfied With Malaysia Airports Holdings Berhad's (KLSE:AIRPORT) Prospects

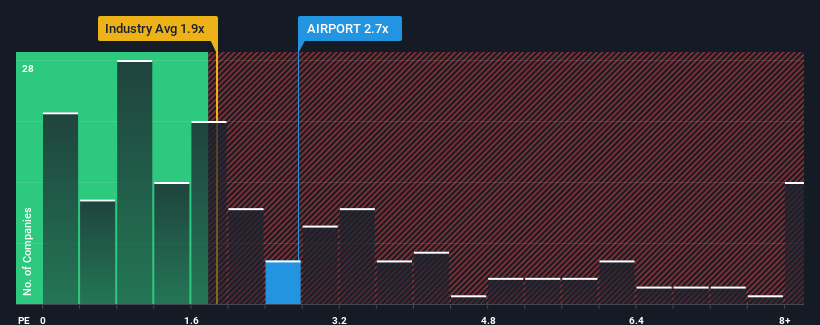

With a median price-to-sales (or "P/S") ratio of close to 2.7x in the Infrastructure industry in Malaysia, you could be forgiven for feeling indifferent about Malaysia Airports Holdings Berhad's (KLSE:AIRPORT) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Malaysia Airports Holdings Berhad

How Has Malaysia Airports Holdings Berhad Performed Recently?

Recent times have been advantageous for Malaysia Airports Holdings Berhad as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Malaysia Airports Holdings Berhad.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Malaysia Airports Holdings Berhad would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 70%. Pleasingly, revenue has also lifted 54% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 20% as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 21%, which is not materially different.

In light of this, it's understandable that Malaysia Airports Holdings Berhad's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Malaysia Airports Holdings Berhad's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Malaysia Airports Holdings Berhad's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Infrastructure industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Malaysia Airports Holdings Berhad with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Malaysia Airports Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AIRPORT

Malaysia Airports Holdings Berhad

An investment holding company, engages in the development, management, operation, and maintenance of airports.

Solid track record with moderate growth potential.