- Malaysia

- /

- Wireless Telecom

- /

- KLSE:XOX

Investors Don't See Light At End Of XOX Berhad's (KLSE:XOX) Tunnel And Push Stock Down 33%

XOX Berhad (KLSE:XOX) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

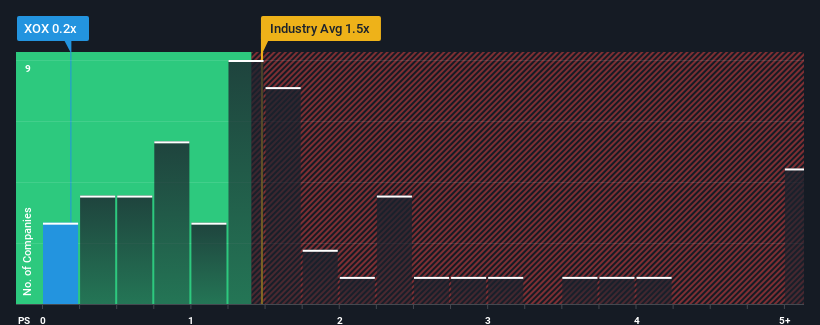

Since its price has dipped substantially, when around half the companies operating in Malaysia's Wireless Telecom industry have price-to-sales ratios (or "P/S") above 2.7x, you may consider XOX Berhad as an incredibly enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for XOX Berhad

What Does XOX Berhad's Recent Performance Look Like?

As an illustration, revenue has deteriorated at XOX Berhad over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on XOX Berhad's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, XOX Berhad would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.8%. Regardless, revenue has managed to lift by a handy 8.8% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 7.2% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why XOX Berhad's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in XOX Berhad have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of XOX Berhad confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - XOX Berhad has 4 warning signs (and 3 which are a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on XOX Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:XOX

XOX Berhad

An investment holding company, provides mobile telecommunication products and services primarily in Malaysia.

Adequate balance sheet low.

Market Insights

Community Narratives