- Malaysia

- /

- Telecom Services and Carriers

- /

- KLSE:TIMECOM

If EPS Growth Is Important To You, TIME dotCom Berhad (KLSE:TIMECOM) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like TIME dotCom Berhad (KLSE:TIMECOM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide TIME dotCom Berhad with the means to add long-term value to shareholders.

TIME dotCom Berhad's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. To the delight of shareholders, TIME dotCom Berhad's EPS soared from RM0.16 to RM0.21, over the last year. That's a commendable gain of 31%.

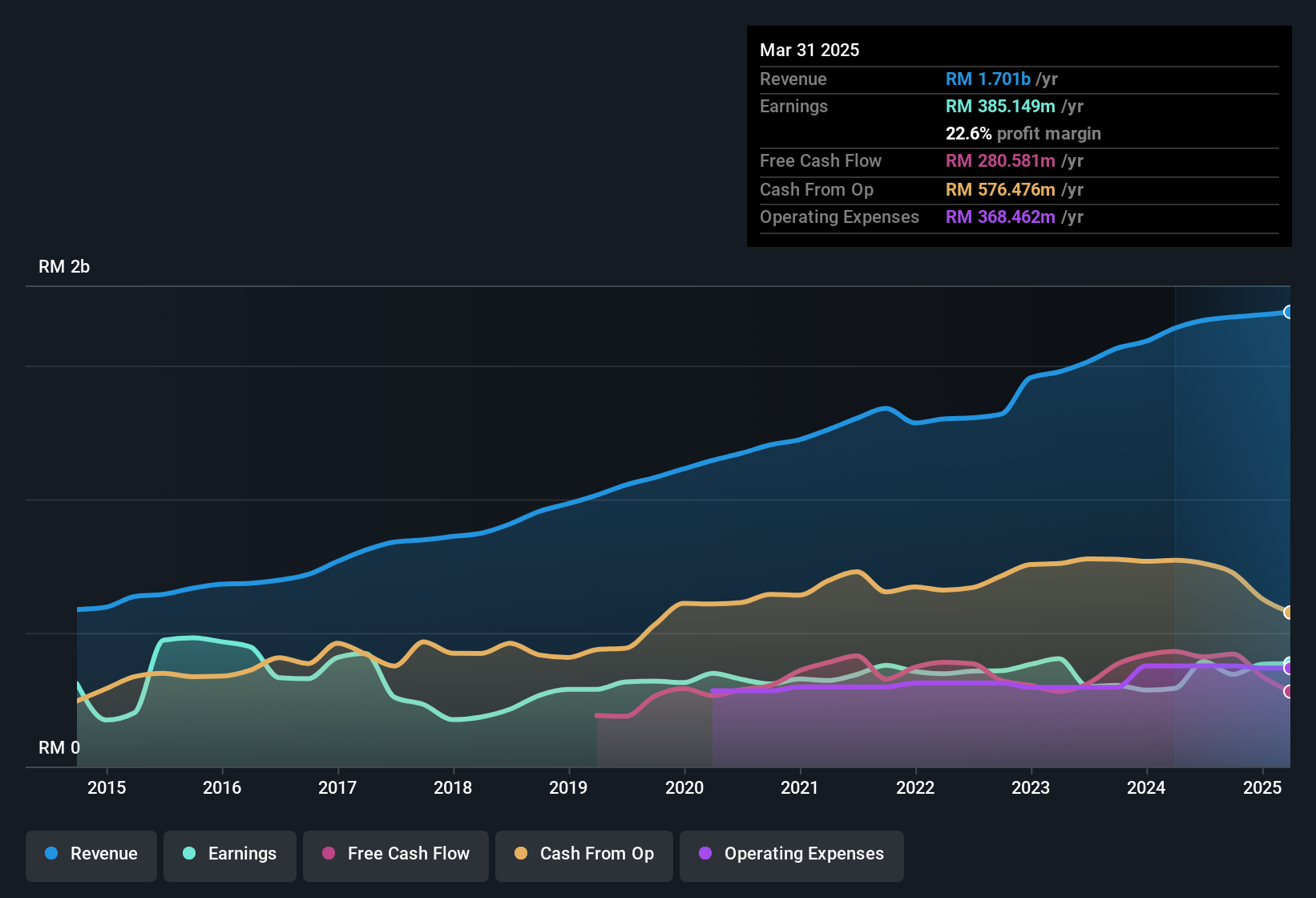

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of TIME dotCom Berhad shareholders is that EBIT margins have grown from 26% to 29% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Check out our latest analysis for TIME dotCom Berhad

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for TIME dotCom Berhad's future profits.

Are TIME dotCom Berhad Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that TIME dotCom Berhad insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth RM1.1b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like TIME dotCom Berhad with market caps between RM4.2b and RM14b is about RM3.1m.

TIME dotCom Berhad offered total compensation worth RM1.9m to its CEO in the year to December 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does TIME dotCom Berhad Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into TIME dotCom Berhad's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the key takeaway is that TIME dotCom Berhad is worth keeping an eye on. What about risks? Every company has them, and we've spotted 1 warning sign for TIME dotCom Berhad you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in MY with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TIME dotCom Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TIMECOM

TIME dotCom Berhad

An investment holding company, provides telecommunications services in Malaysia and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026