- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:IQGROUP

Here's Why Shareholders May Want To Be Cautious With Increasing IQ Group Holdings Berhad's (KLSE:IQGROUP) CEO Pay Packet

Key Insights

- IQ Group Holdings Berhad will host its Annual General Meeting on 26th of August

- Total pay for CEO Daniel Beasley includes RM1.13m salary

- The overall pay is 397% above the industry average

- IQ Group Holdings Berhad's EPS grew by 40% over the past three years while total shareholder loss over the past three years was 27%

Shareholders of IQ Group Holdings Berhad (KLSE:IQGROUP) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 26th of August. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for IQ Group Holdings Berhad

How Does Total Compensation For Daniel Beasley Compare With Other Companies In The Industry?

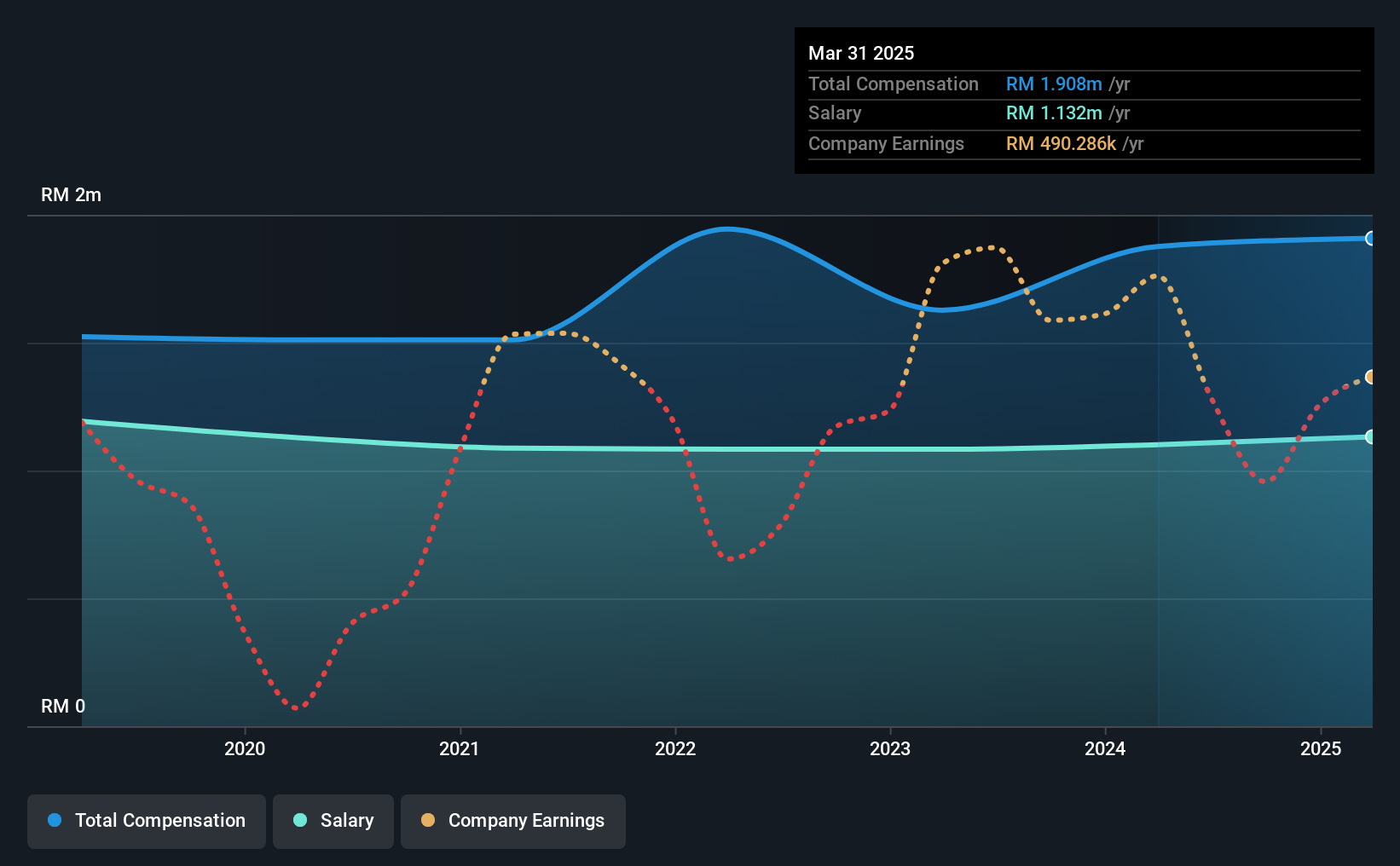

At the time of writing, our data shows that IQ Group Holdings Berhad has a market capitalization of RM48m, and reported total annual CEO compensation of RM1.9m for the year to March 2025. This means that the compensation hasn't changed much from last year. We note that the salary of RM1.13m makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Malaysian Electronic industry with market capitalizations under RM844m, the reported median total CEO compensation was RM384k. Hence, we can conclude that Daniel Beasley is remunerated higher than the industry median.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | RM1.1m | RM1.1m | 59% |

| Other | RM776k | RM775k | 41% |

| Total Compensation | RM1.9m | RM1.9m | 100% |

On an industry level, roughly 81% of total compensation represents salary and 19% is other remuneration. It's interesting to note that IQ Group Holdings Berhad allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at IQ Group Holdings Berhad's Growth Numbers

Over the past three years, IQ Group Holdings Berhad has seen its earnings per share (EPS) grow by 40% per year. It saw its revenue drop 12% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has IQ Group Holdings Berhad Been A Good Investment?

Since shareholders would have lost about 27% over three years, some IQ Group Holdings Berhad investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for IQ Group Holdings Berhad that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IQGROUP

IQ Group Holdings Berhad

An investment holding company, engages in the design, manufacture, supply of lighting, security, and convenience products.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026