- Malaysia

- /

- Semiconductors

- /

- KLSE:INARI

Do Inari Amertron Berhad's (KLSE:INARI) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Inari Amertron Berhad (KLSE:INARI). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Inari Amertron Berhad

How Quickly Is Inari Amertron Berhad Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Inari Amertron Berhad has grown EPS by 13% per year. That's a good rate of growth, if it can be sustained.

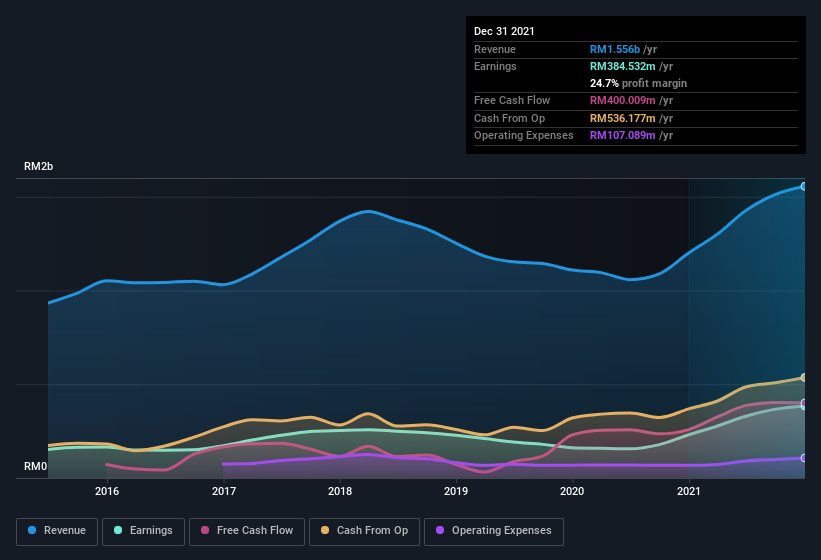

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Inari Amertron Berhad shareholders can take confidence from the fact that EBIT margins are up from 21% to 24%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Inari Amertron Berhad EPS 100% free.

Are Inari Amertron Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Inari Amertron Berhad insiders have a significant amount of capital invested in the stock. Given insiders own a small fortune of shares, currently valued at RM303m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

Does Inari Amertron Berhad Deserve A Spot On Your Watchlist?

One positive for Inari Amertron Berhad is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Still, you should learn about the 3 warning signs we've spotted with Inari Amertron Berhad .

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:INARI

Inari Amertron Berhad

An investment holding company, engages in the provision of electronic manufacturing, outsourced semiconductor assembly, and testing services for radio frequency, fiber-optics transceivers, optoelectronics, memory modules, sensors, and custom integrated circuit (IC) technologies in Malaysia, Singapore, the United States, China, Hong Kong, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives