- Malaysia

- /

- Communications

- /

- KLSE:HEXCAP

Hextar Capital Berhad's (KLSE:HEXCAP) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Hextar Capital Berhad's (KLSE:HEXCAP) stock is up by a considerable 24% over the past week. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Hextar Capital Berhad's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Hextar Capital Berhad

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hextar Capital Berhad is:

1.1% = RM2.1m ÷ RM202m (Based on the trailing twelve months to September 2023).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each MYR1 of shareholders' capital it has, the company made MYR0.01 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Hextar Capital Berhad's Earnings Growth And 1.1% ROE

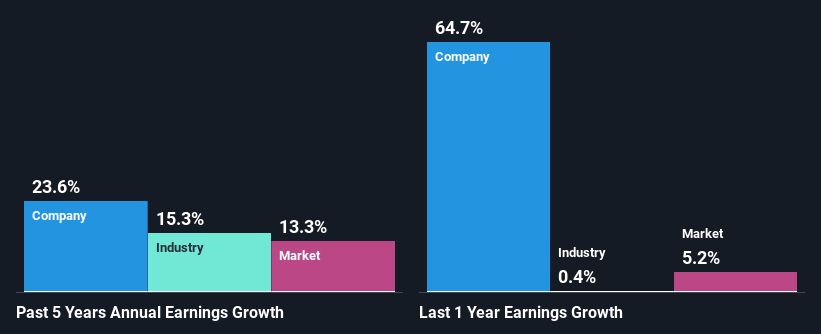

It is quite clear that Hextar Capital Berhad's ROE is rather low. Not just that, even compared to the industry average of 7.2%, the company's ROE is entirely unremarkable. In spite of this, Hextar Capital Berhad was able to grow its net income considerably, at a rate of 24% in the last five years. We reckon that there could be other factors at play here. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Hextar Capital Berhad's growth is quite high when compared to the industry average growth of 15% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Hextar Capital Berhad fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Hextar Capital Berhad Using Its Retained Earnings Effectively?

Hextar Capital Berhad doesn't pay any regular dividends currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the high earnings growth number that we discussed above.

Conclusion

Overall, we feel that Hextar Capital Berhad certainly does have some positive factors to consider. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 3 risks we have identified for Hextar Capital Berhad by visiting our risks dashboard for free on our platform here.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hextar Capital Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HEXCAP

Hextar Capital Berhad

An investment holding company, manufactures and sells fiber optic cables, systems, accessories, and thixotropic gel in Malaysia, the United Kingdom, China, and internationally.

Fair value with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)