Infoline Tec Group Berhad's (KLSE:INFOTEC) Shareholders May Want To Dig Deeper Than Statutory Profit

Infoline Tec Group Berhad (KLSE:INFOTEC) just released a solid earnings report, and the stock displayed some strength. While the profit numbers were good, our analysis has found some concerning factors that shareholders should be aware of.

Check out the opportunities and risks within the MY IT industry.

A Closer Look At Infoline Tec Group Berhad's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

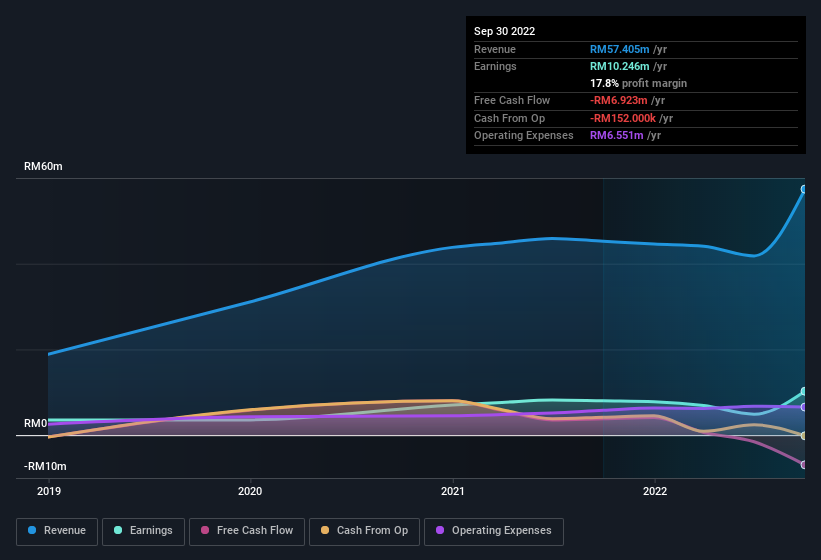

Over the twelve months to September 2022, Infoline Tec Group Berhad recorded an accrual ratio of 1.23. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of RM6.9m, in contrast to the aforementioned profit of RM10.2m. We saw that FCF was RM3.8m a year ago though, so Infoline Tec Group Berhad has at least been able to generate positive FCF in the past.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Infoline Tec Group Berhad's Profit Performance

As we discussed above, we think Infoline Tec Group Berhad's earnings were not supported by free cash flow, which might concern some investors. For this reason, we think that Infoline Tec Group Berhad's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To help with this, we've discovered 2 warning signs (1 doesn't sit too well with us!) that you ought to be aware of before buying any shares in Infoline Tec Group Berhad.

This note has only looked at a single factor that sheds light on the nature of Infoline Tec Group Berhad's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:INFOTEC

Infoline Tec Group Berhad

An investment holding company, provides information technology (IT) infrastructure and cybersecurity solutions, and managed IT and other IT services.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026