Is Cuscapi Berhad's (KLSE:CUSCAPI) 113% Share Price Increase Well Justified?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For example, the Cuscapi Berhad (KLSE:CUSCAPI) share price has soared 113% in the last half decade. Most would be very happy with that. Better yet, the share price has gained 168% in the last quarter.

See our latest analysis for Cuscapi Berhad

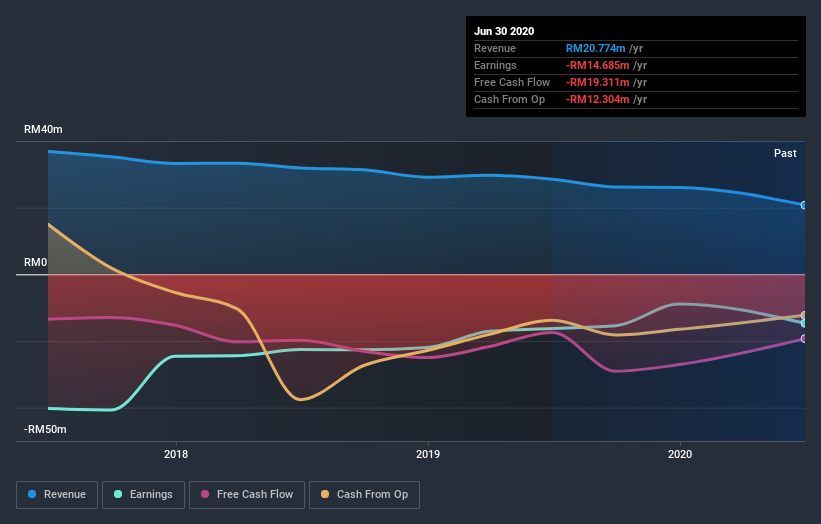

Because Cuscapi Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade Cuscapi Berhad's revenue has actually been trending down at about 13% per year. Given that scenario, we wouldn't have expected the share price to rise 16% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Cuscapi Berhad's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Cuscapi Berhad shareholders have received a total shareholder return of 96% over the last year. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Cuscapi Berhad that you should be aware of before investing here.

Of course Cuscapi Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Cuscapi Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CUSCAPI

Cuscapi Berhad

An investment holding company, engages in the software development business in Malaysia and rest of the South East Asia.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026