Shareholders May Be More Conservative With Censof Holdings Berhad's (KLSE:CENSOF) CEO Compensation For Now

Under the guidance of CEO Ameer Bin Shaik Mydin, Censof Holdings Berhad (KLSE:CENSOF) has performed reasonably well recently. As shareholders go into the upcoming AGM on 08 September 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Censof Holdings Berhad

Comparing Censof Holdings Berhad's CEO Compensation With the industry

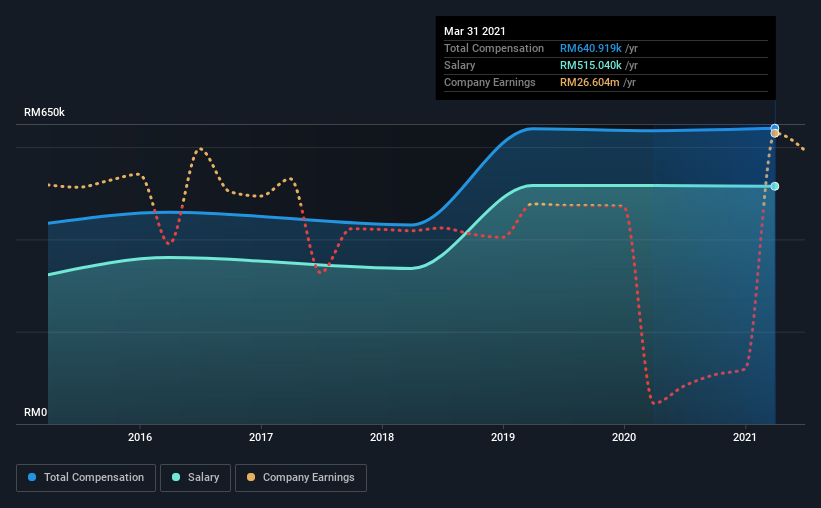

Our data indicates that Censof Holdings Berhad has a market capitalization of RM202m, and total annual CEO compensation was reported as RM641k for the year to March 2021. This means that the compensation hasn't changed much from last year. In particular, the salary of RM515.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below RM831m, we found that the median total CEO compensation was RM145k. Accordingly, our analysis reveals that Censof Holdings Berhad pays Ameer Bin Shaik Mydin north of the industry median. Furthermore, Ameer Bin Shaik Mydin directly owns RM518k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM515k | RM517k | 80% |

| Other | RM126k | RM119k | 20% |

| Total Compensation | RM641k | RM636k | 100% |

Talking in terms of the industry, salary represented approximately 88% of total compensation out of all the companies we analyzed, while other remuneration made up 12% of the pie. Censof Holdings Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Censof Holdings Berhad's Growth

Censof Holdings Berhad has reduced its earnings per share by 20% a year over the last three years. Its revenue is up 22% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Censof Holdings Berhad Been A Good Investment?

Most shareholders would probably be pleased with Censof Holdings Berhad for providing a total return of 107% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The overall company performance has been commendable, however there are still areas for improvement. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 4 warning signs for Censof Holdings Berhad that investors should look into moving forward.

Important note: Censof Holdings Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CENSOF

Censof Holdings Berhad

An investment holding company, engages in the design, development, implementation, and marketing of financial management software in Malaysia, Singapore, and Indonesia.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026