ARB Berhad's (KLSE:ARBB) Returns On Capital Are Heading Higher

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, we've noticed some promising trends at ARB Berhad (KLSE:ARBB) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for ARB Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.042 = RM19m ÷ (RM511m - RM66m) (Based on the trailing twelve months to June 2023).

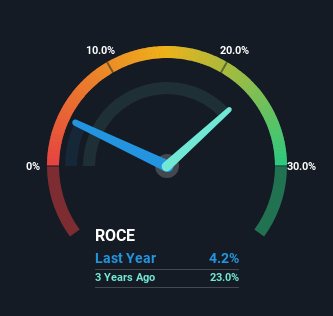

So, ARB Berhad has an ROCE of 4.2%. Ultimately, that's a low return and it under-performs the IT industry average of 27%.

View our latest analysis for ARB Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for ARB Berhad's ROCE against it's prior returns. If you're interested in investigating ARB Berhad's past further, check out this free graph of past earnings, revenue and cash flow.

So How Is ARB Berhad's ROCE Trending?

ARB Berhad has recently broken into profitability so their prior investments seem to be paying off. The company was generating losses five years ago, but now it's earning 4.2% which is a sight for sore eyes. Not only that, but the company is utilizing 2,511% more capital than before, but that's to be expected from a company trying to break into profitability. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, both common traits of a multi-bagger.

The Key Takeaway

To the delight of most shareholders, ARB Berhad has now broken into profitability. And since the stock has fallen 66% over the last five years, there might be an opportunity here. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

One more thing to note, we've identified 3 warning signs with ARB Berhad and understanding them should be part of your investment process.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ARBB

ARB Berhad

An investment holding company, designs and develops Cloud, Customer Relationship Management (CRM), and platform solutions in Malaysia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)