Just Four Days Till Autocount Dotcom Berhad (KLSE:ADB) Will Be Trading Ex-Dividend

Readers hoping to buy Autocount Dotcom Berhad (KLSE:ADB) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Thus, you can purchase Autocount Dotcom Berhad's shares before the 11th of March in order to receive the dividend, which the company will pay on the 26th of March.

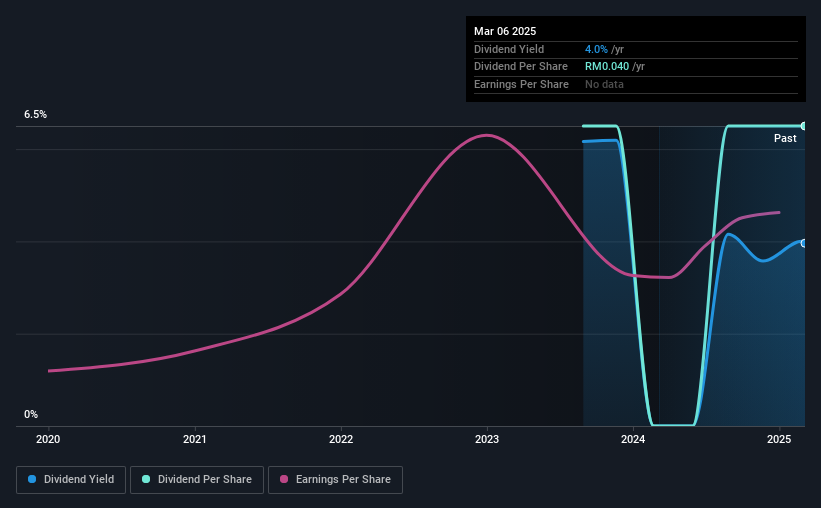

The company's upcoming dividend is RM00.02 a share, following on from the last 12 months, when the company distributed a total of RM0.04 per share to shareholders. Based on the last year's worth of payments, Autocount Dotcom Berhad has a trailing yield of 4.0% on the current stock price of RM01.01. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Autocount Dotcom Berhad has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Autocount Dotcom Berhad

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Autocount Dotcom Berhad paid out 112% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year, it paid out more than three-quarters (85%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's good to see that while Autocount Dotcom Berhad's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see how much of its profit Autocount Dotcom Berhad paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Autocount Dotcom Berhad's earnings have been skyrocketing, up 31% per annum for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Autocount Dotcom Berhad's dividend payments are effectively flat on where they were two years ago.

Final Takeaway

Is Autocount Dotcom Berhad an attractive dividend stock, or better left on the shelf? Autocount Dotcom Berhad has been growing its earnings per share nicely, although judging by the difference between its profit and cashflow payout ratios, the company might have reported some write-offs over the last year. To summarise, Autocount Dotcom Berhad looks okay on this analysis, although it doesn't appear a stand-out opportunity.

So if you want to do more digging on Autocount Dotcom Berhad, you'll find it worthwhile knowing the risks that this stock faces. To help with this, we've discovered 3 warning signs for Autocount Dotcom Berhad (2 can't be ignored!) that you ought to be aware of before buying the shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ADB

Autocount Dotcom Berhad

A software development company, develops and distributes financial management software under the AutoCount brand in Malaysia, Singapore, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)