- Malaysia

- /

- Semiconductors

- /

- KLSE:OPPSTAR

What You Can Learn From Oppstar Berhad's (KLSE:OPPSTAR) P/S After Its 26% Share Price Crash

Oppstar Berhad (KLSE:OPPSTAR) shares have had a horrible month, losing 26% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

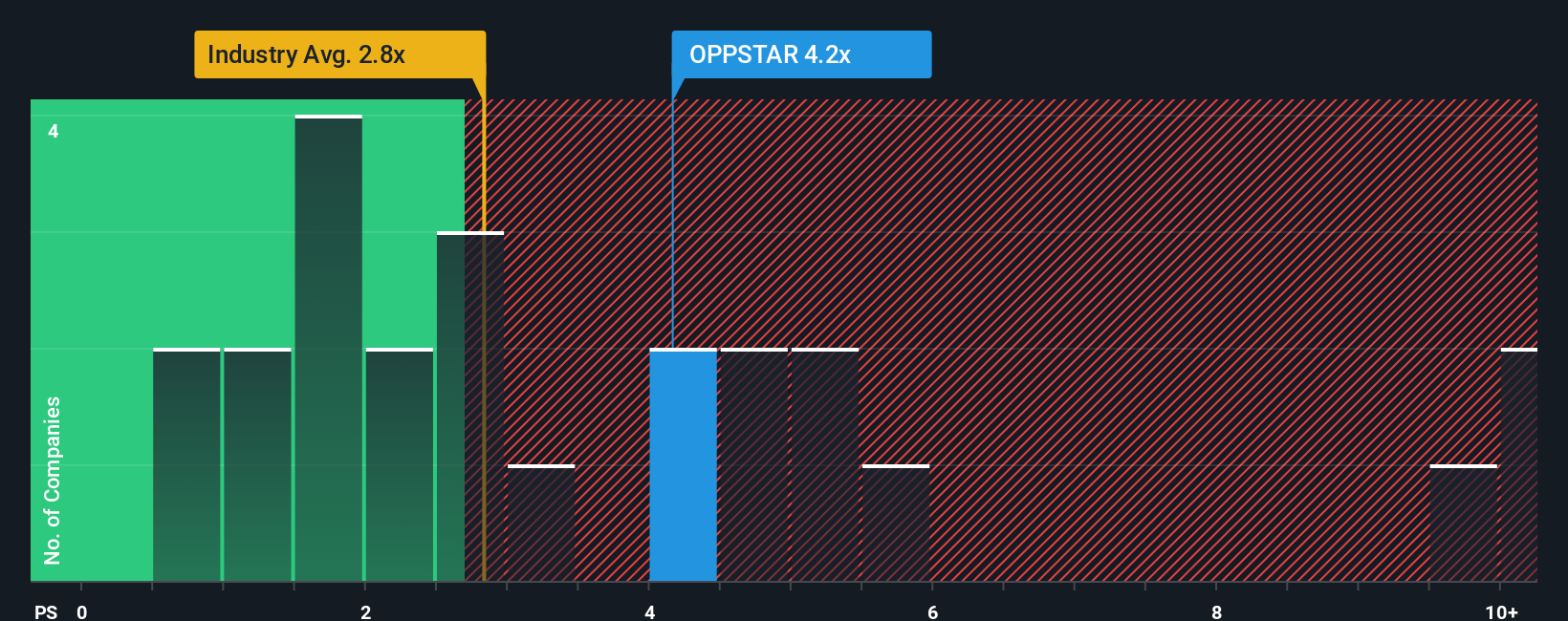

In spite of the heavy fall in price, you could still be forgiven for thinking Oppstar Berhad is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.2x, considering almost half the companies in Malaysia's Semiconductor industry have P/S ratios below 2.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Oppstar Berhad

How Oppstar Berhad Has Been Performing

Oppstar Berhad certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Oppstar Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Oppstar Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Oppstar Berhad would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Revenue has also lifted 27% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 9.6%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Oppstar Berhad's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Oppstar Berhad's P/S Mean For Investors?

Despite the recent share price weakness, Oppstar Berhad's P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Oppstar Berhad maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Oppstar Berhad (1 is a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OPPSTAR

Oppstar Berhad

Provides IC design and other related services in Malaysia, Singapore, Japan, and the People’s Republic of China.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.