- Malaysia

- /

- Semiconductors

- /

- KLSE:KESM

We Think KESM Industries Berhad's (KLSE:KESM) CEO Compensation Package Needs To Be Put Under A Microscope

Key Insights

- KESM Industries Berhad to hold its Annual General Meeting on 11th of January

- Salary of RM664.2k is part of CEO Samuel Lim's total remuneration

- Total compensation is similar to the industry average

- Over the past three years, KESM Industries Berhad's EPS fell by 58% and over the past three years, the total loss to shareholders 47%

The results at KESM Industries Berhad (KLSE:KESM) have been quite disappointing recently and CEO Samuel Lim bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 11th of January. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for KESM Industries Berhad

Comparing KESM Industries Berhad's CEO Compensation With The Industry

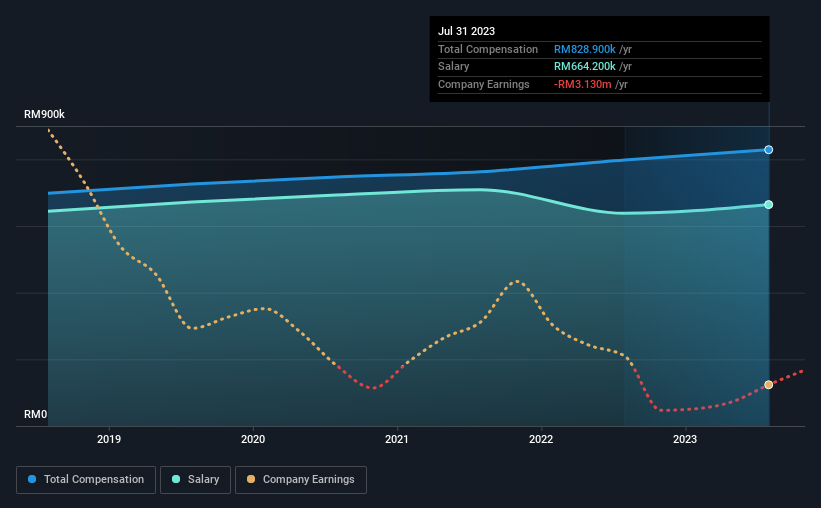

According to our data, KESM Industries Berhad has a market capitalization of RM296m, and paid its CEO total annual compensation worth RM829k over the year to July 2023. That's a fairly small increase of 3.9% over the previous year. In particular, the salary of RM664.2k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Malaysian Semiconductor industry with market capitalizations under RM927m, the reported median total CEO compensation was RM673k. From this we gather that Samuel Lim is paid around the median for CEOs in the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM664k | RM638k | 80% |

| Other | RM165k | RM160k | 20% |

| Total Compensation | RM829k | RM798k | 100% |

Talking in terms of the industry, salary represented approximately 83% of total compensation out of all the companies we analyzed, while other remuneration made up 17% of the pie. KESM Industries Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at KESM Industries Berhad's Growth Numbers

Over the last three years, KESM Industries Berhad has shrunk its earnings per share by 58% per year. It achieved revenue growth of 5.4% over the last year.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has KESM Industries Berhad Been A Good Investment?

The return of -47% over three years would not have pleased KESM Industries Berhad shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for KESM Industries Berhad that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if KESM Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KESM

KESM Industries Berhad

An investment holding company, provides burn-in and test services to semiconductor manufacturers in Malaysia, the People’s Republic of China, the United States, Europe, and rest of Asia.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives