Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Tomei Consolidated Berhad (KLSE:TOMEI) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Tomei Consolidated Berhad

What Is Tomei Consolidated Berhad's Debt?

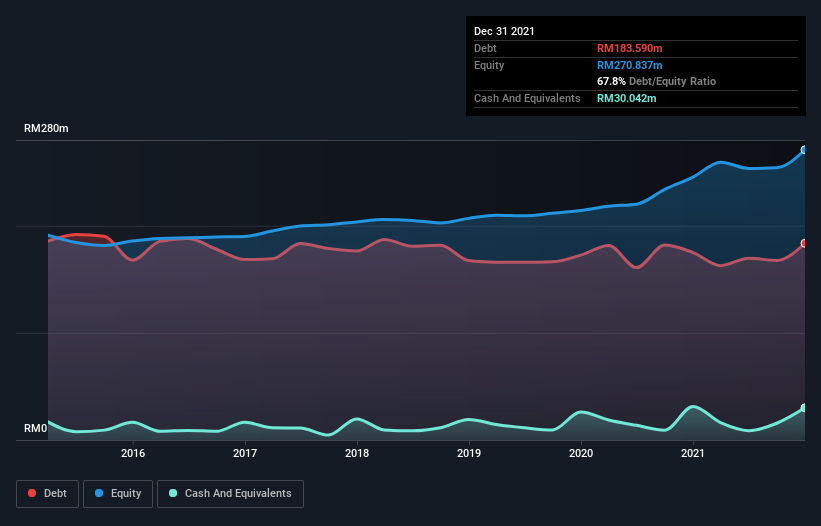

You can click the graphic below for the historical numbers, but it shows that as of December 2021 Tomei Consolidated Berhad had RM183.6m of debt, an increase on RM175.0m, over one year. However, it also had RM30.0m in cash, and so its net debt is RM153.5m.

A Look At Tomei Consolidated Berhad's Liabilities

We can see from the most recent balance sheet that Tomei Consolidated Berhad had liabilities of RM213.5m falling due within a year, and liabilities of RM29.7m due beyond that. Offsetting these obligations, it had cash of RM30.0m as well as receivables valued at RM47.1m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM166.1m.

Given this deficit is actually higher than the company's market capitalization of RM128.9m, we think shareholders really should watch Tomei Consolidated Berhad's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Tomei Consolidated Berhad's debt is 2.7 times its EBITDA, and its EBIT cover its interest expense 6.3 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One way Tomei Consolidated Berhad could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 14%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Tomei Consolidated Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Tomei Consolidated Berhad's free cash flow amounted to 43% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Mulling over Tomei Consolidated Berhad's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that Tomei Consolidated Berhad's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Tomei Consolidated Berhad (1 is potentially serious) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tomei Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TOMEI

Tomei Consolidated Berhad

An investment holding company, engages in manufacturing, retailing, and wholesale of gold ornaments and jewelry in Malaysia.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)