- Malaysia

- /

- Specialty Stores

- /

- KLSE:MRDIY

Mr D.I.Y. Group (M) Berhad's (KLSE:MRDIY) Popularity With Investors Is Clear

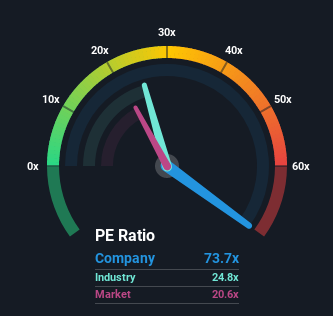

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 20x, you may consider Mr D.I.Y. Group (M) Berhad (KLSE:MRDIY) as a stock to avoid entirely with its 73.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Mr D.I.Y. Group (M) Berhad certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Mr D.I.Y. Group (M) Berhad

How Is Mr D.I.Y. Group (M) Berhad's Growth Trending?

Mr D.I.Y. Group (M) Berhad's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 8.0% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 100% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 30% per annum over the next three years. With the market only predicted to deliver 17% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Mr D.I.Y. Group (M) Berhad's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Mr D.I.Y. Group (M) Berhad's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Mr D.I.Y. Group (M) Berhad with six simple checks.

You might be able to find a better investment than Mr D.I.Y. Group (M) Berhad. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Mr D.I.Y. Group (M) Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MRDIY

Mr D.I.Y. Group (M) Berhad

An investment holding company, engages in the retail of home improvement products, mass merchandise, games, toys, groceries, and related business and activities in Malaysia and Brunei.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives