Astro Malaysia Holdings Berhad (KLSE:ASTRO) investors are sitting on a loss of 81% if they invested three years ago

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Astro Malaysia Holdings Berhad (KLSE:ASTRO), who have seen the share price tank a massive 82% over a three year period. That'd be enough to cause even the strongest minds some disquiet. The more recent news is of little comfort, with the share price down 46% in a year. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Astro Malaysia Holdings Berhad

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

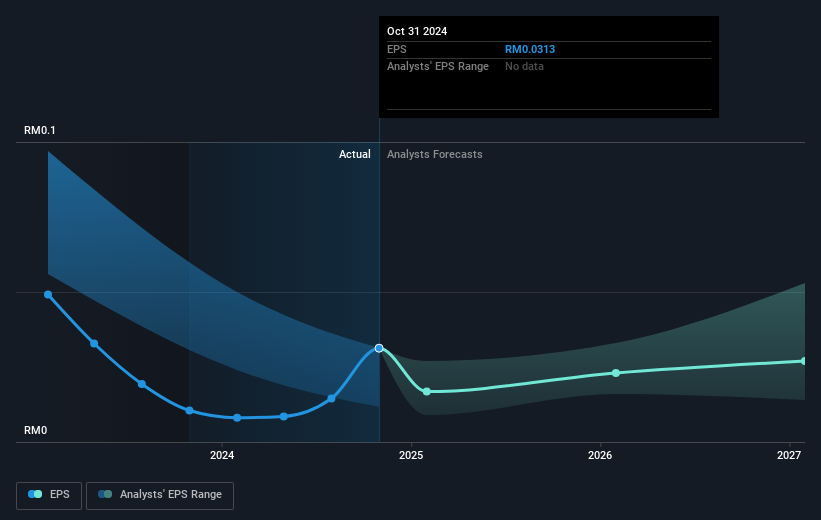

Astro Malaysia Holdings Berhad saw its EPS decline at a compound rate of 31% per year, over the last three years. This reduction in EPS is slower than the 44% annual reduction in the share price. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 5.76.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Astro Malaysia Holdings Berhad has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

Astro Malaysia Holdings Berhad shareholders are down 46% for the year, but the market itself is up 1.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Astro Malaysia Holdings Berhad .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ASTRO

Astro Malaysia Holdings Berhad

Through its subsidiaries, operates as a content and entertainment company in Malaysia and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives