Capital Allocation Trends At SLP Resources Berhad (KLSE:SLP) Aren't Ideal

If you're looking at a mature business that's past the growth phase, what are some of the underlying trends that pop up? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. On that note, looking into SLP Resources Berhad (KLSE:SLP), we weren't too upbeat about how things were going.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for SLP Resources Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

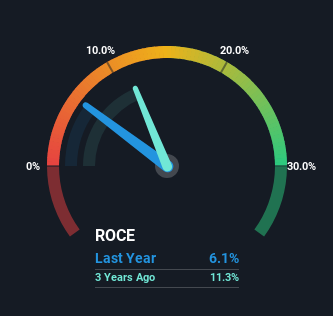

0.061 = RM12m ÷ (RM220m - RM19m) (Based on the trailing twelve months to December 2023).

Thus, SLP Resources Berhad has an ROCE of 6.1%. In absolute terms, that's a low return and it also under-performs the Packaging industry average of 8.8%.

View our latest analysis for SLP Resources Berhad

Above you can see how the current ROCE for SLP Resources Berhad compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for SLP Resources Berhad .

What Can We Tell From SLP Resources Berhad's ROCE Trend?

We are a bit worried about the trend of returns on capital at SLP Resources Berhad. To be more specific, the ROCE was 14% five years ago, but since then it has dropped noticeably. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect SLP Resources Berhad to turn into a multi-bagger.

What We Can Learn From SLP Resources Berhad's ROCE

In summary, it's unfortunate that SLP Resources Berhad is generating lower returns from the same amount of capital. Despite the concerning underlying trends, the stock has actually gained 20% over the last five years, so it might be that the investors are expecting the trends to reverse. Regardless, we don't like the trends as they are and if they persist, we think you might find better investments elsewhere.

On a final note, we found 3 warning signs for SLP Resources Berhad (1 is concerning) you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SLP

SLP Resources Berhad

An investment holding company, manufactures and sells plastic packaging and related products in Malaysia, Japan, Australia, New Zealand, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)