- Malaysia

- /

- Metals and Mining

- /

- KLSE:PMETAL

Do Press Metal Aluminium Holdings Berhad's (KLSE:PMETAL) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Press Metal Aluminium Holdings Berhad (KLSE:PMETAL), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Press Metal Aluminium Holdings Berhad

How Quickly Is Press Metal Aluminium Holdings Berhad Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Press Metal Aluminium Holdings Berhad has managed to grow EPS by 17% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

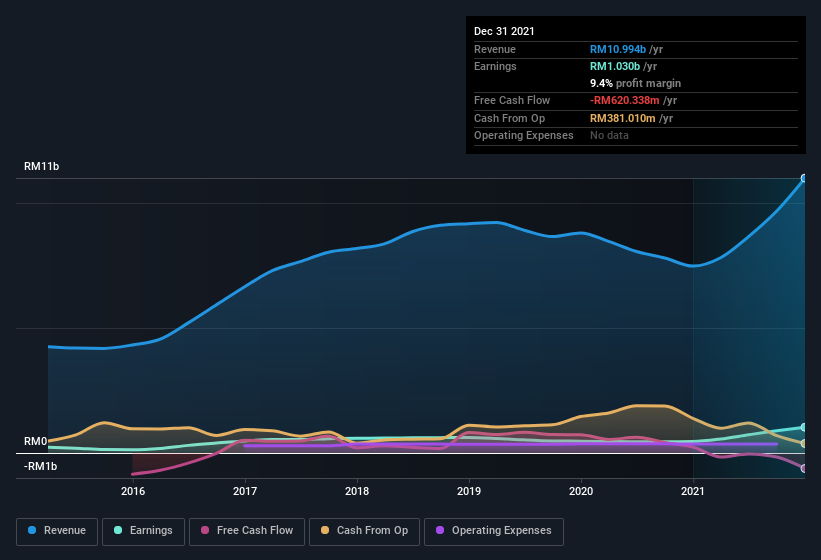

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Press Metal Aluminium Holdings Berhad shareholders can take confidence from the fact that EBIT margins are up from 11% to 14%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Press Metal Aluminium Holdings Berhad.

Are Press Metal Aluminium Holdings Berhad Insiders Aligned With All Shareholders?

Since Press Metal Aluminium Holdings Berhad has a market capitalization of RM50b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at RM13b. That equates to 26% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Press Metal Aluminium Holdings Berhad, with market caps over RM34b, is about RM9.6m.

The Press Metal Aluminium Holdings Berhad CEO received total compensation of just RM2.4m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Press Metal Aluminium Holdings Berhad To Your Watchlist?

You can't deny that Press Metal Aluminium Holdings Berhad has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Each to their own, but I think all this makes Press Metal Aluminium Holdings Berhad look rather interesting indeed. It is worth noting though that we have found 1 warning sign for Press Metal Aluminium Holdings Berhad that you need to take into consideration.

Although Press Metal Aluminium Holdings Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Press Metal Aluminium Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PMETAL

Press Metal Aluminium Holdings Berhad

Engages in the manufacture and trading of aluminum, and smelting and extrusion products in Malaysia, Asia, Europe, the Oceania, Europe, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives