Lotte Chemical Titan Holding Berhad's (KLSE:LCTITAN) Shares Lagging The Industry But So Is The Business

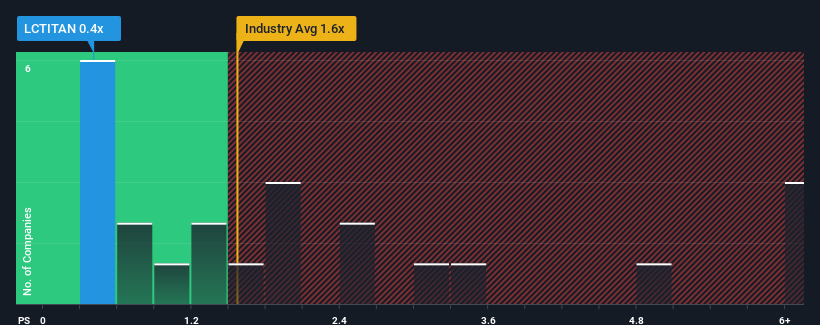

When you see that almost half of the companies in the Chemicals industry in Malaysia have price-to-sales ratios (or "P/S") above 1.6x, Lotte Chemical Titan Holding Berhad (KLSE:LCTITAN) looks to be giving off some buy signals with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Lotte Chemical Titan Holding Berhad

What Does Lotte Chemical Titan Holding Berhad's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Lotte Chemical Titan Holding Berhad's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Lotte Chemical Titan Holding Berhad will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Lotte Chemical Titan Holding Berhad's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 13% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 3.4% each year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.2% per annum, which is noticeably more attractive.

With this information, we can see why Lotte Chemical Titan Holding Berhad is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Lotte Chemical Titan Holding Berhad's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Lotte Chemical Titan Holding Berhad's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Lotte Chemical Titan Holding Berhad with six simple checks on some of these key factors.

If you're unsure about the strength of Lotte Chemical Titan Holding Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LCTITAN

Lotte Chemical Titan Holding Berhad

Engages in manufacture and sale of petrochemical products and polyolefin resins in Malaysia, Indonesia, China, Southeast Asia, Northeast Asia, Indian Sub-Continent, and internationally.

Fair value very low.

Market Insights

Community Narratives