- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:HEVEA

A Quick Analysis On HeveaBoard Berhad's (KLSE:HEVEA) CEO Compensation

Hau Yoong became the CEO of HeveaBoard Berhad (KLSE:HEVEA) in 2012, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for HeveaBoard Berhad

Comparing HeveaBoard Berhad's CEO Compensation With the industry

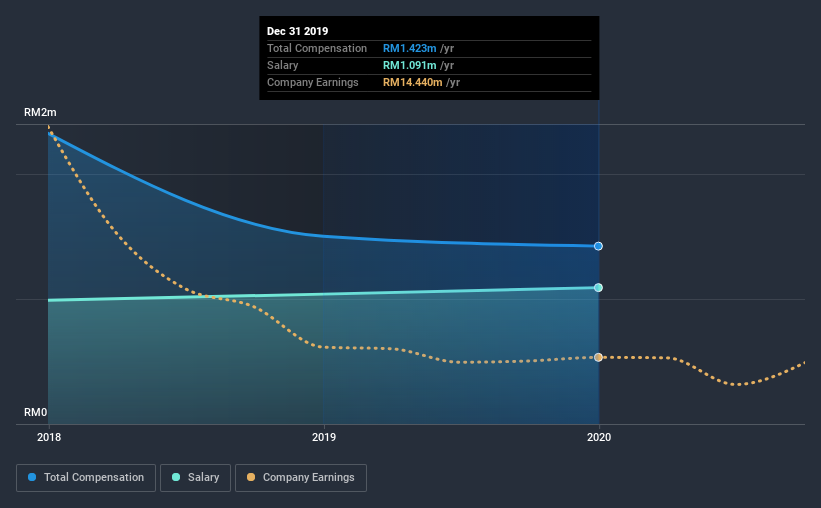

At the time of writing, our data shows that HeveaBoard Berhad has a market capitalization of RM405m, and reported total annual CEO compensation of RM1.4m for the year to December 2019. That's a slight decrease of 5.3% on the prior year. We note that the salary portion, which stands at RM1.09m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below RM812m, we found that the median total CEO compensation was RM526k. Hence, we can conclude that Hau Yoong is remunerated higher than the industry median. Furthermore, Hau Yoong directly owns RM14m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM1.1m | RM1.0m | 77% |

| Other | RM332k | RM463k | 23% |

| Total Compensation | RM1.4m | RM1.5m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. In HeveaBoard Berhad's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

HeveaBoard Berhad's Growth

Over the last three years, HeveaBoard Berhad has shrunk its earnings per share by 46% per year. Its revenue is down 8.4% over the previous year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has HeveaBoard Berhad Been A Good Investment?

Since shareholders would have lost about 25% over three years, some HeveaBoard Berhad investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, HeveaBoard Berhad pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Disappointingly, share price gains over the last three years have failed to materialize. To make matters worse, EPS growth has also been negative during this period. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for HeveaBoard Berhad that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade HeveaBoard Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HeveaBoard Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HEVEA

HeveaBoard Berhad

An investment holding company, manufactures, trades in, and distributes particleboards and particleboard-based products.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.