- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:HEXRTL

Why Classic Scenic Berhad's (KLSE:CSCENIC) Earnings Are Better Than They Seem

The market seemed underwhelmed by the solid earnings posted by Classic Scenic Berhad (KLSE:CSCENIC) recently. Our analysis suggests that there are some reasons for hope that investors should be aware of.

See our latest analysis for Classic Scenic Berhad

Zooming In On Classic Scenic Berhad's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

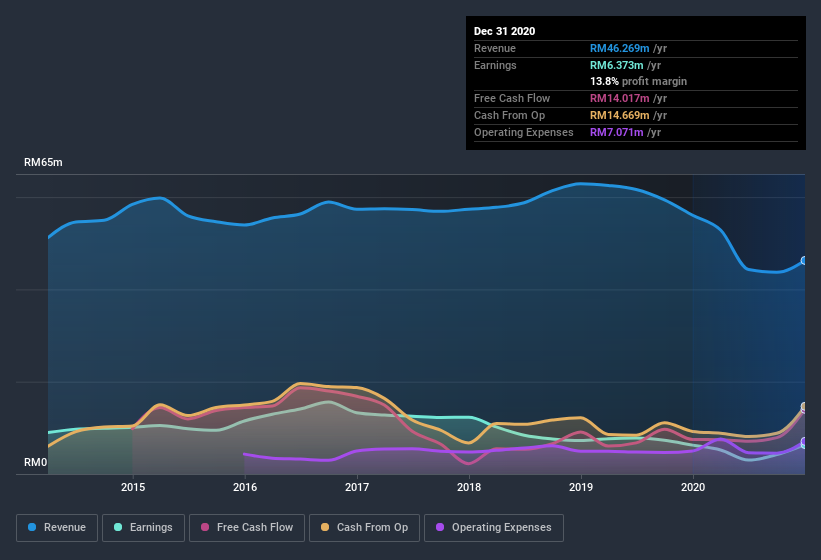

For the year to December 2020, Classic Scenic Berhad had an accrual ratio of -0.10. That indicates that its free cash flow was a fair bit more than its statutory profit. In fact, it had free cash flow of RM14m in the last year, which was a lot more than its statutory profit of RM6.37m. Classic Scenic Berhad's free cash flow improved over the last year, which is generally good to see.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Classic Scenic Berhad.

Our Take On Classic Scenic Berhad's Profit Performance

As we discussed above, Classic Scenic Berhad has perfectly satisfactory free cash flow relative to profit. Based on this observation, we consider it likely that Classic Scenic Berhad's statutory profit actually understates its earnings potential! Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing Classic Scenic Berhad at this point in time. Our analysis shows 4 warning signs for Classic Scenic Berhad (1 is potentially serious!) and we strongly recommend you look at these before investing.

This note has only looked at a single factor that sheds light on the nature of Classic Scenic Berhad's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Classic Scenic Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hextar Retail Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HEXRTL

Hextar Retail Berhad

An investment holding company, engages in the manufacture and sale of wooden picture frame moldings in North America, Australia, Malaysia, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)