- Malaysia

- /

- Medical Equipment

- /

- KLSE:KOSSAN

The Price Is Right For Kossan Rubber Industries Bhd (KLSE:KOSSAN) Even After Diving 29%

Kossan Rubber Industries Bhd (KLSE:KOSSAN) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Looking at the bigger picture, even after this poor month the stock is up 27% in the last year.

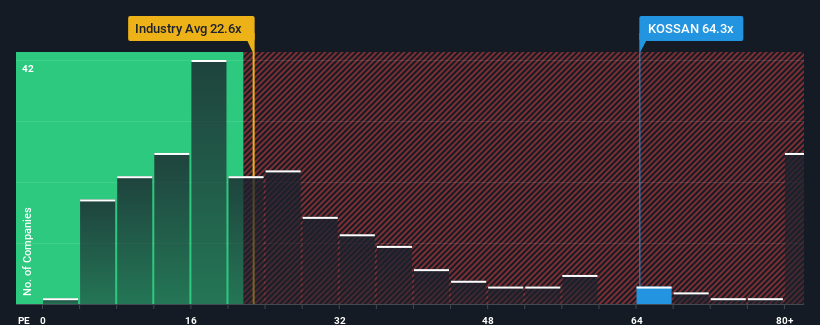

Although its price has dipped substantially, given close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 17x, you may still consider Kossan Rubber Industries Bhd as a stock to avoid entirely with its 64.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for Kossan Rubber Industries Bhd as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Kossan Rubber Industries Bhd

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Kossan Rubber Industries Bhd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 62% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 97% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 53% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 15% per year growth forecast for the broader market.

With this information, we can see why Kossan Rubber Industries Bhd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

A significant share price dive has done very little to deflate Kossan Rubber Industries Bhd's very lofty P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Kossan Rubber Industries Bhd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Kossan Rubber Industries Bhd (1 doesn't sit too well with us!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kossan Rubber Industries Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:KOSSAN

Kossan Rubber Industries Bhd

An investment holding company, manufactures and sells latex disposable gloves in Malaysia and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives