- Malaysia

- /

- Healthcare Services

- /

- KLSE:DCHCARE

DC Healthcare Holdings Berhad (KLSE:DCHCARE) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the DC Healthcare Holdings Berhad (KLSE:DCHCARE) share price has dived 27% in the last thirty days, prolonging recent pain. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

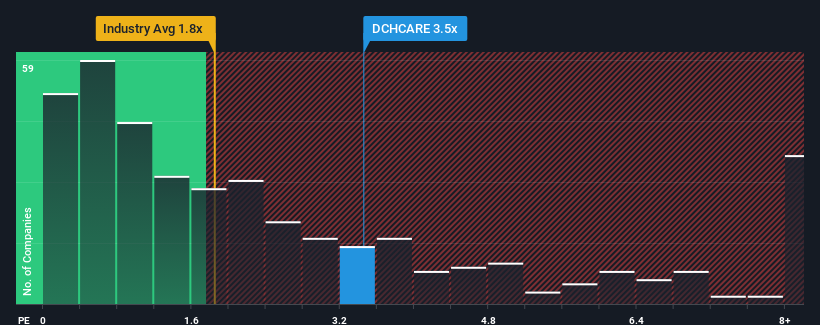

Even after such a large drop in price, when almost half of the companies in Malaysia's Healthcare industry have price-to-sales ratios (or "P/S") below 2.8x, you may still consider DC Healthcare Holdings Berhad as a stock probably not worth researching with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for DC Healthcare Holdings Berhad

What Does DC Healthcare Holdings Berhad's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, DC Healthcare Holdings Berhad has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for DC Healthcare Holdings Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For DC Healthcare Holdings Berhad?

DC Healthcare Holdings Berhad's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 45%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 1.8% shows it's a great look while it lasts.

With this information, we can see why DC Healthcare Holdings Berhad is trading at a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What We Can Learn From DC Healthcare Holdings Berhad's P/S?

DC Healthcare Holdings Berhad's P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of DC Healthcare Holdings Berhad revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

You should always think about risks. Case in point, we've spotted 4 warning signs for DC Healthcare Holdings Berhad you should be aware of, and 1 of them shouldn't be ignored.

If these risks are making you reconsider your opinion on DC Healthcare Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade DC Healthcare Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:DCHCARE

DC Healthcare Holdings Berhad

An investment holding company, provides aesthetic medical services specializing in non-invasive and minimally invasive procedures in Malaysia.

Excellent balance sheet very low.

Market Insights

Community Narratives