- Malaysia

- /

- Medical Equipment

- /

- KLSE:CAREPLS

Investors ignore increasing losses at Careplus Group Berhad (KLSE:CAREPLS) as stock jumps 15% this past week

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. One great example is Careplus Group Berhad (KLSE:CAREPLS) which saw its share price drive 126% higher over five years. Better yet, the share price has risen 15% in the last week.

Since it's been a strong week for Careplus Group Berhad shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Careplus Group Berhad

Careplus Group Berhad isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Careplus Group Berhad saw its revenue shrink by 9.2% per year. On the other hand, the share price done the opposite, gaining 18%, compound, each year. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

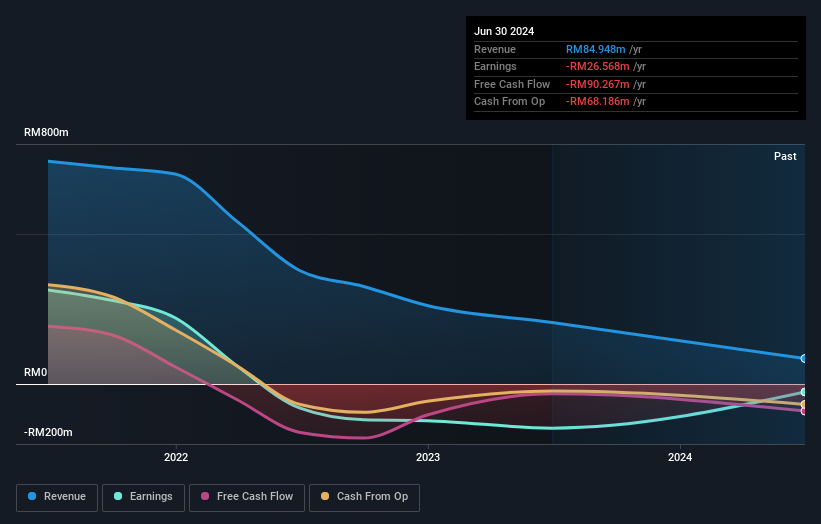

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Careplus Group Berhad's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Careplus Group Berhad's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Careplus Group Berhad's TSR of 134% over the last 5 years is better than the share price return.

A Different Perspective

Careplus Group Berhad provided a TSR of 11% over the last twelve months. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 19% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Careplus Group Berhad is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CAREPLS

Careplus Group Berhad

An investment holding company, engages in the manufacture and processing of gloves in South America, North America, Malaysia, rest of Asia Pacific, and internationally.

Adequate balance sheet low.