Do United Plantations Berhad's (KLSE:UTDPLT) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like United Plantations Berhad (KLSE:UTDPLT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide United Plantations Berhad with the means to add long-term value to shareholders.

See our latest analysis for United Plantations Berhad

How Fast Is United Plantations Berhad Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that United Plantations Berhad's EPS has grown 21% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that United Plantations Berhad's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. United Plantations Berhad's EBIT margins have actually improved by 10.0 percentage points in the last year, to reach 43%, but, on the flip side, revenue was down 17%. That's not a good look.

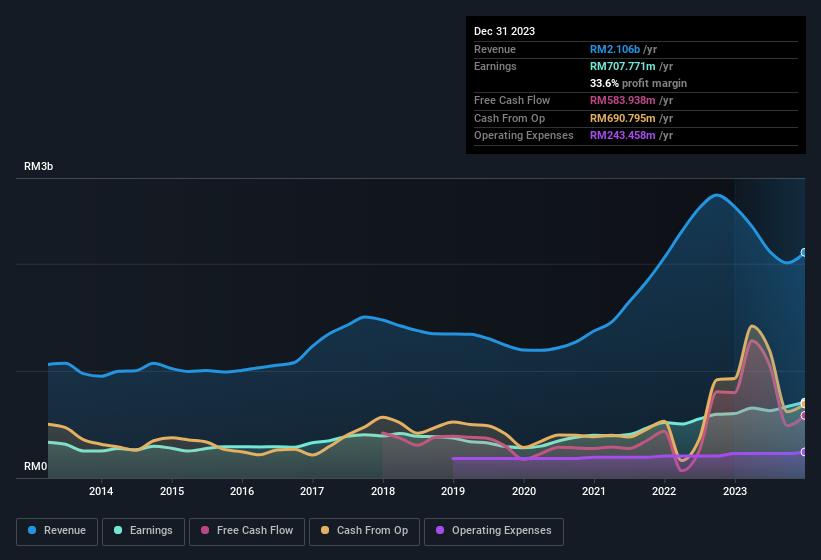

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are United Plantations Berhad Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that United Plantations Berhad insiders have a significant amount of capital invested in the stock. Holding RM363m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This would indicate that the goals of shareholders and management are one and the same.

Is United Plantations Berhad Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into United Plantations Berhad's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with United Plantations Berhad , and understanding this should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in MY with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:UTDPLT

United Plantations Berhad

Engages in the cultivation and processing of oil palm and coconuts in Malaysia, Indonesia, Europe, the United States, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives