Here's Why I Think TH Plantations Berhad (KLSE:THPLANT) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like TH Plantations Berhad (KLSE:THPLANT), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for TH Plantations Berhad

How Fast Is TH Plantations Berhad Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that TH Plantations Berhad's EPS went from RM0.016 to RM0.079 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that TH Plantations Berhad is growing revenues, and EBIT margins improved by 4.7 percentage points to 27%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

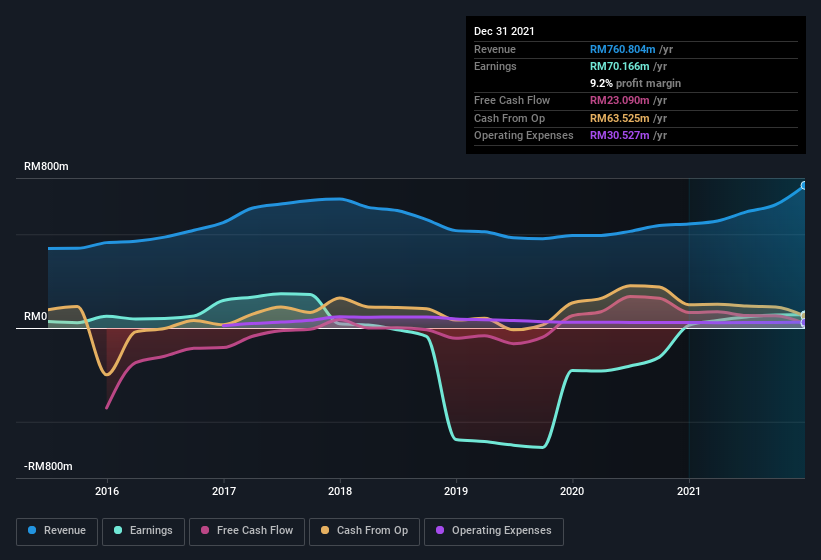

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of TH Plantations Berhad's forecast profits?

Are TH Plantations Berhad Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own TH Plantations Berhad shares worth a considerable sum. To be specific, they have RM63m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 8.1% of the company; visible skin in the game.

Does TH Plantations Berhad Deserve A Spot On Your Watchlist?

TH Plantations Berhad's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind TH Plantations Berhad is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with TH Plantations Berhad (at least 2 which are concerning) , and understanding these should be part of your investment process.

Although TH Plantations Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade TH Plantations Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TH Plantations Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:THPLANT

TH Plantations Berhad

An investment holding company, engages in the cultivation of oil palm in Malaysia and Indonesia.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives