One Malayan Flour Mills Berhad (KLSE:MFLOUR) Analyst Has Been Cutting Their Forecasts

The analyst covering Malayan Flour Mills Berhad (KLSE:MFLOUR) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

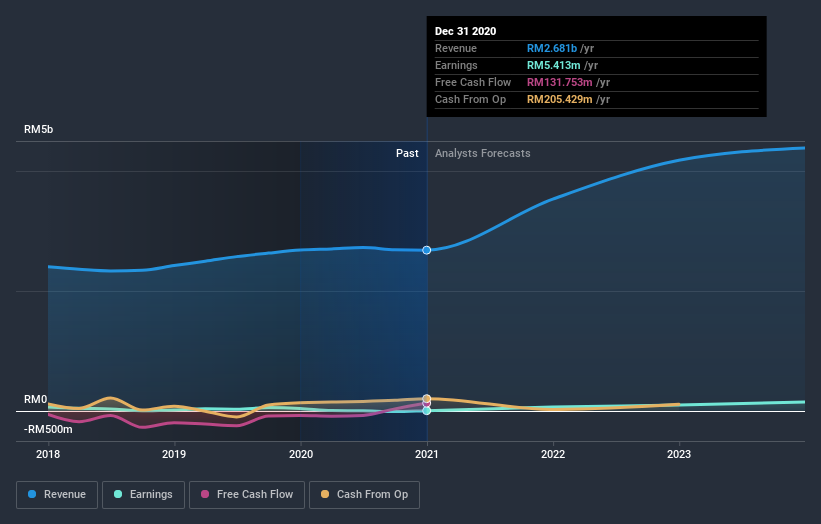

After this downgrade, Malayan Flour Mills Berhad's lone analyst is now forecasting revenues of RM3.5b in 2021. This would be a substantial 32% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analyst was forecasting revenues of RM4.0b in 2021. It looks like forecasts have become a fair bit less optimistic on Malayan Flour Mills Berhad, given the measurable cut to revenue estimates.

View our latest analysis for Malayan Flour Mills Berhad

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analyst is definitely expecting Malayan Flour Mills Berhad's growth to accelerate, with the forecast 32% annualised growth to the end of 2021 ranking favourably alongside historical growth of 2.5% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 4.5% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Malayan Flour Mills Berhad is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analyst cut their revenue estimates for this year. They're also forecasting more rapid revenue growth than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Malayan Flour Mills Berhad after today.

That said, the analyst might have good reason to be negative on Malayan Flour Mills Berhad, given its declining profit margins. Learn more, and discover the 2 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Malayan Flour Mills Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MFLOUR

Malayan Flour Mills Berhad

Operates in the flour milling industry in Malaysia and Vietnam.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion