Some Confidence Is Lacking In Fraser & Neave Holdings Bhd's (KLSE:F&N) P/E

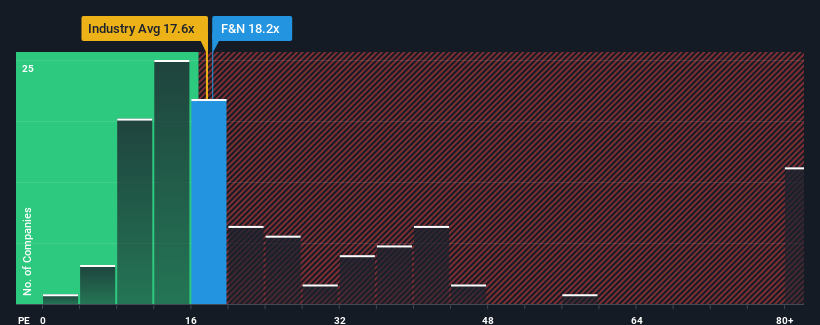

With a price-to-earnings (or "P/E") ratio of 18.2x Fraser & Neave Holdings Bhd (KLSE:F&N) may be sending bearish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios under 15x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Fraser & Neave Holdings Bhd could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Fraser & Neave Holdings Bhd

How Is Fraser & Neave Holdings Bhd's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Fraser & Neave Holdings Bhd's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 7.1% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 16% per annum growth forecast for the broader market.

With this information, we find it concerning that Fraser & Neave Holdings Bhd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Fraser & Neave Holdings Bhd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Fraser & Neave Holdings Bhd with six simple checks on some of these key factors.

If you're unsure about the strength of Fraser & Neave Holdings Bhd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:F&N

Fraser & Neave Holdings Bhd

An investment holding company, primarily engages in the manufacture, sale, trading, and distribution of soft drinks, dairy, and food products in South East Asia, the Middle East, Africa, China, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives