- Malaysia

- /

- Energy Services

- /

- KLSE:T7GLOBAL

Earnings growth of 14% over 1 year hasn't been enough to translate into positive returns for T7 Global Berhad (KLSE:T7GLOBAL) shareholders

The nature of investing is that you win some, and you lose some. Unfortunately, shareholders of T7 Global Berhad (KLSE:T7GLOBAL) have suffered share price declines over the last year. To wit the share price is down 52% in that time. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 28% in three years. Furthermore, it's down 50% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

We've discovered 4 warning signs about T7 Global Berhad. View them for free.There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the T7 Global Berhad share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

T7 Global Berhad's revenue is actually up 11% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

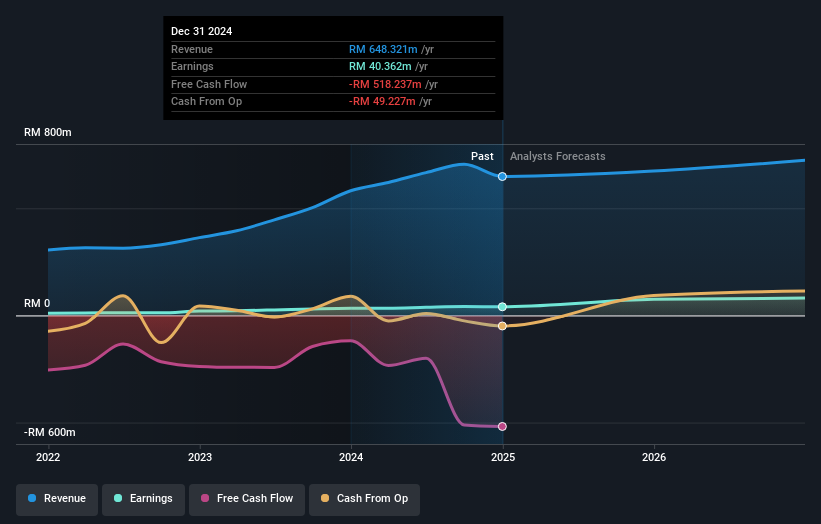

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that T7 Global Berhad has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on T7 Global Berhad's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that T7 Global Berhad shareholders are down 52% for the year. Unfortunately, that's worse than the broader market decline of 6.8%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand T7 Global Berhad better, we need to consider many other factors. Take risks, for example - T7 Global Berhad has 4 warning signs (and 3 which are significant) we think you should know about.

We will like T7 Global Berhad better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

If you're looking to trade T7 Global Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if T7 Global Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:T7GLOBAL

T7 Global Berhad

Provides integrated services to the oil and gas, and related industries in Malaysia, the United Arab Emirates, Thailand, and rest of Southeast Asia.

Reasonable growth potential slight.

Market Insights

Community Narratives