- Malaysia

- /

- Capital Markets

- /

- KLSE:INSAS

Insas Berhad (KLSE:INSAS) Is About To Go Ex-Dividend, And It Pays A 2.2% Yield

Readers hoping to buy Insas Berhad (KLSE:INSAS) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 21st of December in order to receive the dividend, which the company will pay on the 13th of January.

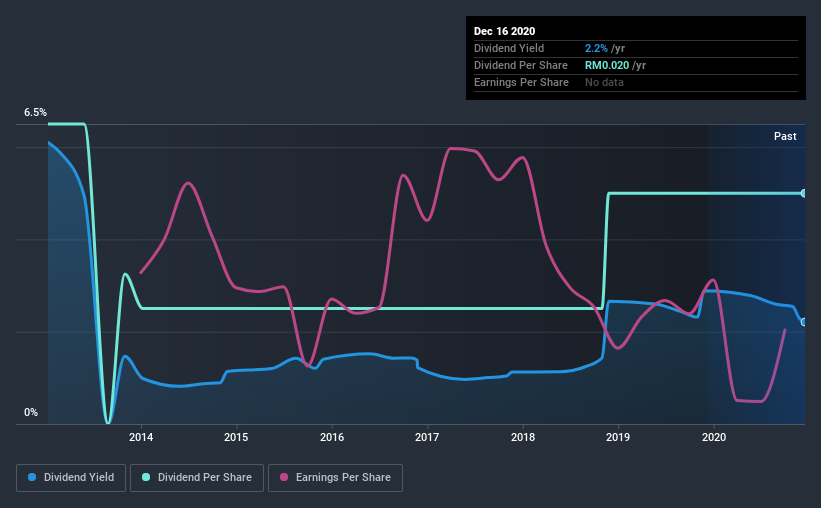

Insas Berhad's next dividend payment will be RM0.02 per share, on the back of last year when the company paid a total of RM0.02 to shareholders. Based on the last year's worth of payments, Insas Berhad stock has a trailing yield of around 2.2% on the current share price of MYR0.905. If you buy this business for its dividend, you should have an idea of whether Insas Berhad's dividend is reliable and sustainable. As a result, readers should always check whether Insas Berhad has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Insas Berhad

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Insas Berhad's payout ratio is modest, at just 43% of profit.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see how much of its profit Insas Berhad paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by Insas Berhad's 7.3% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Insas Berhad's dividend payments per share have declined at 3.2% per year on average over the past eight years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

From a dividend perspective, should investors buy or avoid Insas Berhad? Insas Berhad's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. In sum this is a middling combination, and we find it hard to get excited about the company from a dividend perspective.

If you're not too concerned about Insas Berhad's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. Our analysis shows 2 warning signs for Insas Berhad that we strongly recommend you have a look at before investing in the company.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Insas Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:INSAS

Insas Berhad

An investment holding company, trades in securities in Malaysia, Singapore, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026