- Malaysia

- /

- Consumer Services

- /

- KLSE:SMRT

Does SMRT Holdings Berhad (KLSE:SMRT) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in SMRT Holdings Berhad (KLSE:SMRT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for SMRT Holdings Berhad

How Fast Is SMRT Holdings Berhad Growing Its Earnings Per Share?

SMRT Holdings Berhad has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, SMRT Holdings Berhad's EPS shot from RM0.0091 to RM0.021, over the last year. It's not often a company can achieve year-on-year growth of 128%.

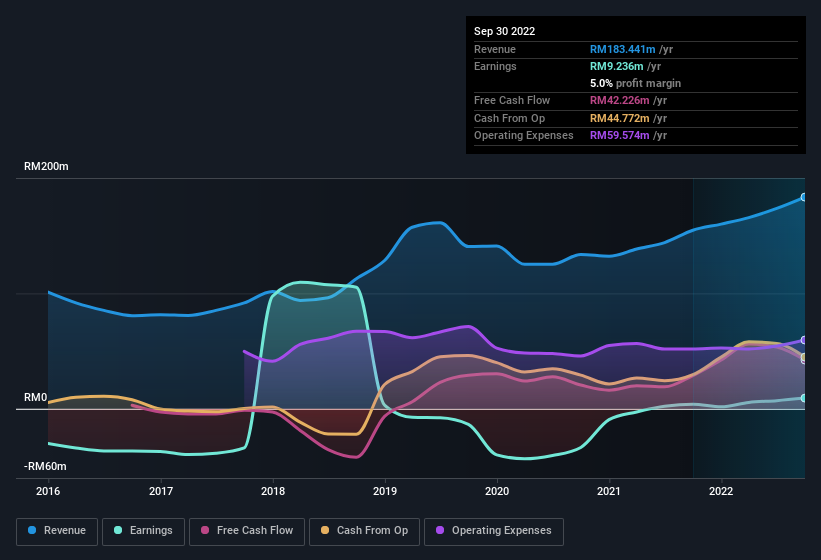

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for SMRT Holdings Berhad remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to RM183m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

SMRT Holdings Berhad isn't a huge company, given its market capitalisation of RM65m. That makes it extra important to check on its balance sheet strength.

Are SMRT Holdings Berhad Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to SMRT Holdings Berhad, with market caps under RM878m is around RM494k.

SMRT Holdings Berhad's CEO only received compensation totalling RM39k in the year to December 2021. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is SMRT Holdings Berhad Worth Keeping An Eye On?

SMRT Holdings Berhad's earnings per share growth have been climbing higher at an appreciable rate. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that SMRT Holdings Berhad has the hallmarks of a quality business; and that would make it well worth watching. However, before you get too excited we've discovered 2 warning signs for SMRT Holdings Berhad that you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SMRT

SMRT Holdings Berhad

An investment holding company, engages information technology businesses primarily in Malaysia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.