Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Minda Global Berhad (KLSE:MINDA) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Minda Global Berhad

What Is Minda Global Berhad's Debt?

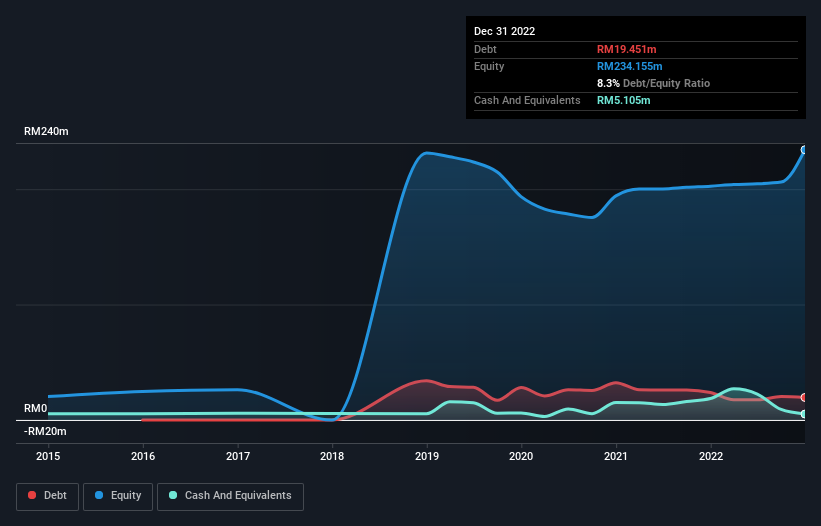

As you can see below, Minda Global Berhad had RM19.5m of debt at December 2022, down from RM23.7m a year prior. On the flip side, it has RM5.11m in cash leading to net debt of about RM14.3m.

How Strong Is Minda Global Berhad's Balance Sheet?

We can see from the most recent balance sheet that Minda Global Berhad had liabilities of RM78.6m falling due within a year, and liabilities of RM146.0m due beyond that. On the other hand, it had cash of RM5.11m and RM77.4m worth of receivables due within a year. So it has liabilities totalling RM142.1m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of RM176.3m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Given net debt is only 0.66 times EBITDA, it is initially surprising to see that Minda Global Berhad's EBIT has low interest coverage of 1.4 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Unfortunately, Minda Global Berhad's EBIT flopped 12% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Minda Global Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Minda Global Berhad created free cash flow amounting to 8.9% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Mulling over Minda Global Berhad's attempt at covering its interest expense with its EBIT, we're certainly not enthusiastic. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. Overall, it seems to us that Minda Global Berhad's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Minda Global Berhad (of which 1 shouldn't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CYBERE

Cyberjaya Education Group Berhad

An investment holding company, provides educational and training services in Malaysia.

Proven track record with low risk.

Market Insights

Community Narratives