- Malaysia

- /

- Consumer Durables

- /

- KLSE:RKI

Rhong Khen International Berhad (KLSE:RKI) Is Paying Out A Dividend Of MYR0.01

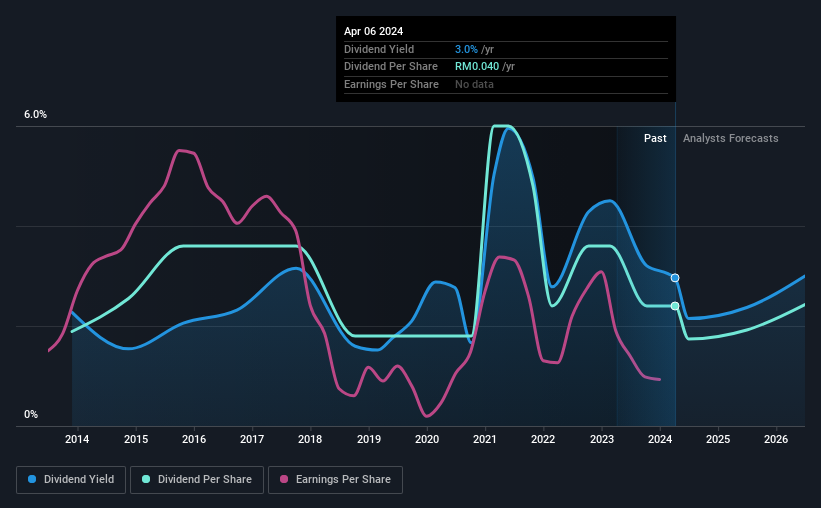

Rhong Khen International Berhad (KLSE:RKI) has announced that it will pay a dividend of MYR0.01 per share on the 10th of May. The dividend yield is 3.0% based on this payment, which is a little bit low compared to the other companies in the industry.

See our latest analysis for Rhong Khen International Berhad

Rhong Khen International Berhad's Earnings Easily Cover The Distributions

If it is predictable over a long period, even low dividend yields can be attractive. The last dividend was quite easily covered by Rhong Khen International Berhad's earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

The next year is set to see EPS grow by 30.9%. Assuming the dividend continues along recent trends, we think the payout ratio could be 40% by next year, which is in a pretty sustainable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the annual payment back then was MYR0.0315, compared to the most recent full-year payment of MYR0.04. This means that it has been growing its distributions at 2.4% per annum over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Rhong Khen International Berhad has seen earnings per share falling at 4.6% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 3 warning signs for Rhong Khen International Berhad that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RKI

Rhong Khen International Berhad

An investment holding company, manufactures and sells wooden household furniture and components in Malaysia, Vietnam, and Thailand.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026