- Malaysia

- /

- Commercial Services

- /

- KLSE:FRONTKN

Do Frontken Corporation Berhad's (KLSE:FRONTKN) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Frontken Corporation Berhad (KLSE:FRONTKN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Frontken Corporation Berhad

How Quickly Is Frontken Corporation Berhad Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Frontken Corporation Berhad's EPS has grown 35% each year, compound, over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

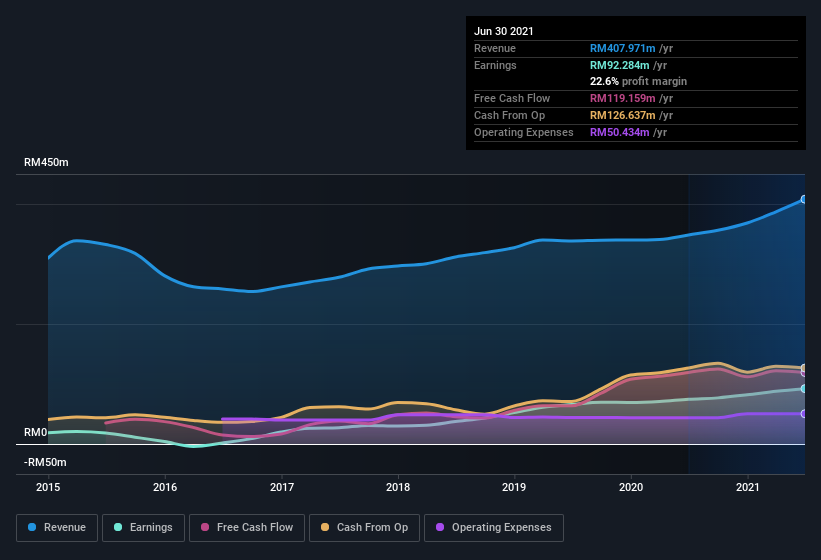

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Frontken Corporation Berhad maintained stable EBIT margins over the last year, all while growing revenue 17% to RM408m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Frontken Corporation Berhad's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Frontken Corporation Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Frontken Corporation Berhad shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at RM1.2b. That equates to 21% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Is Frontken Corporation Berhad Worth Keeping An Eye On?

For growth investors like me, Frontken Corporation Berhad's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Frontken Corporation Berhad shapes up to industry peers, when it comes to ROE.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:FRONTKN

Frontken Corporation Berhad

An investment holding company, provides surface treatment, and mechanical and chemical engineering works in Malaysia, Singapore, the Philippines, Taiwan, and Indonesia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives