- Malaysia

- /

- Commercial Services

- /

- KLSE:CGB

Most Shareholders Will Probably Agree With Central Global Berhad's (KLSE:CGB) CEO Compensation

Key Insights

- Central Global Berhad to hold its Annual General Meeting on 25th of June

- Total pay for CEO Hian Chew includes RM495.0k salary

- Total compensation is similar to the industry average

- Over the past three years, Central Global Berhad's EPS fell by 42% and over the past three years, the total shareholder return was 58%

Despite strong share price growth of 58% for Central Global Berhad (KLSE:CGB) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 25th of June. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for Central Global Berhad

Comparing Central Global Berhad's CEO Compensation With The Industry

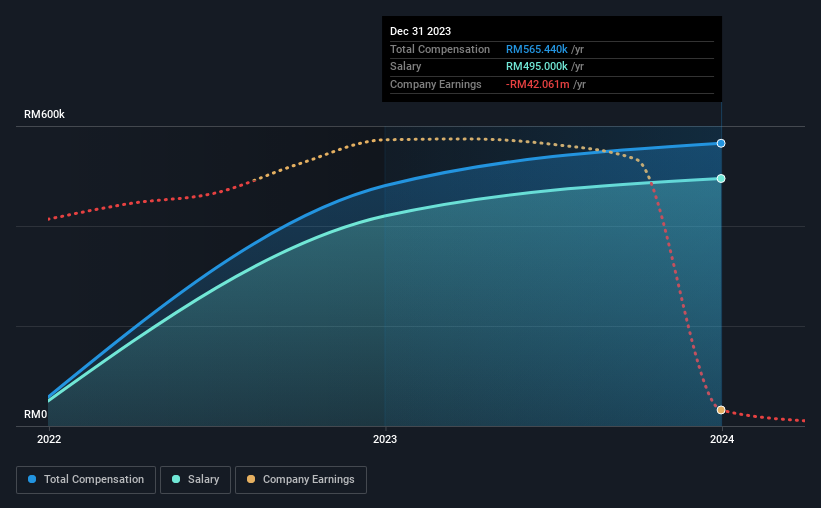

Our data indicates that Central Global Berhad has a market capitalization of RM618m, and total annual CEO compensation was reported as RM565k for the year to December 2023. That's a notable increase of 18% on last year. Notably, the salary which is RM495.0k, represents most of the total compensation being paid.

For comparison, other companies in the Malaysia Commercial Services industry with market capitalizations below RM943m, reported a median total CEO compensation of RM702k. This suggests that Central Global Berhad remunerates its CEO largely in line with the industry average. Moreover, Hian Chew also holds RM165m worth of Central Global Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM495k | RM420k | 88% |

| Other | RM70k | RM60k | 12% |

| Total Compensation | RM565k | RM480k | 100% |

Talking in terms of the industry, salary represented approximately 80% of total compensation out of all the companies we analyzed, while other remuneration made up 20% of the pie. Although there is a difference in how total compensation is set, Central Global Berhad more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Central Global Berhad's Growth Numbers

Over the last three years, Central Global Berhad has shrunk its earnings per share by 42% per year. It saw its revenue drop 19% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Central Global Berhad Been A Good Investment?

Boasting a total shareholder return of 58% over three years, Central Global Berhad has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Central Global Berhad (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Central Global Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:CGB

Central Global Berhad

An investment holding company, engages in construction activities in Malaysia, rest of Asia, Australia, the United States, Europe, and internationally.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Community Narratives