- Malaysia

- /

- Commercial Services

- /

- KLSE:BTECH

Can Mixed Fundamentals Have A Negative Impact on Brite-Tech Berhad (KLSE:BTECH) Current Share Price Momentum?

Brite-Tech Berhad (KLSE:BTECH) has had a great run on the share market with its stock up by a significant 16% over the last month. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study Brite-Tech Berhad's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Brite-Tech Berhad

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Brite-Tech Berhad is:

10% = RM6.5m ÷ RM62m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every MYR1 worth of shareholders' equity, the company generated MYR0.10 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Brite-Tech Berhad's Earnings Growth And 10% ROE

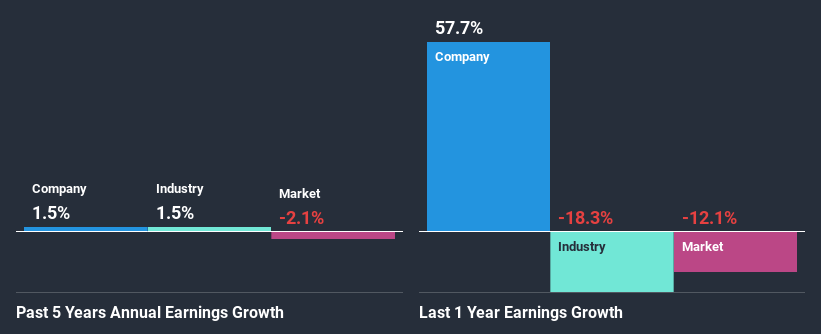

On the face of it, Brite-Tech Berhad's ROE is not much to talk about. However, the fact that the its ROE is quite higher to the industry average of 2.4% doesn't go unnoticed by us. Still, Brite-Tech Berhad has seen a flat net income growth over the past five years. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. Therefore, the low to flat growth in earnings could also be the result of this.

We then performed a comparison between Brite-Tech Berhad's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 1.5% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Brite-Tech Berhad is trading on a high P/E or a low P/E, relative to its industry.

Is Brite-Tech Berhad Using Its Retained Earnings Effectively?

The high three-year median payout ratio of 97% (meaning, the company retains only 2.6% of profits) for Brite-Tech Berhad suggests that the company's earnings growth was miniscule as a result of paying out a majority of its earnings.

Additionally, Brite-Tech Berhad has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

On the whole, we feel that the performance shown by Brite-Tech Berhad can be open to many interpretations. While the company has a decent earnings growth backed by a moderate ROE, we do think that it is reinvesting only a very small portion of its profits, which may hurt future growth. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Brite-Tech Berhad's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Brite-Tech Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brite-Tech Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:BTECH

Brite-Tech Berhad

An investment holding company, provides integrated water purification and wastewater treatment solutions in Malaysia.

Solid track record, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)