- Malaysia

- /

- Trade Distributors

- /

- KLSE:TSA

Why It Might Not Make Sense To Buy TSA Group Berhad (KLSE:TSA) For Its Upcoming Dividend

TSA Group Berhad (KLSE:TSA) is about to trade ex-dividend in the next 4 days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. This means that investors who purchase TSA Group Berhad's shares on or after the 10th of March will not receive the dividend, which will be paid on the 26th of March.

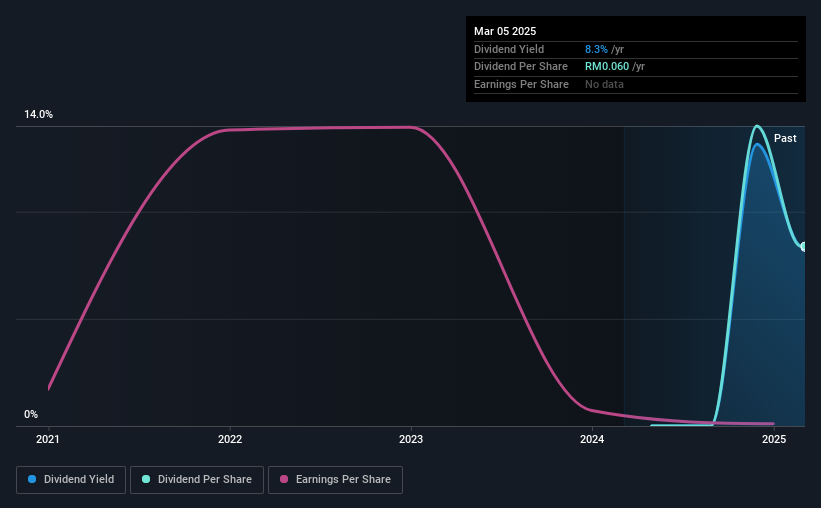

The upcoming dividend for TSA Group Berhad will put a total of RM00.01 per share in shareholders' pockets. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether TSA Group Berhad can afford its dividend, and if the dividend could grow.

View our latest analysis for TSA Group Berhad

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year TSA Group Berhad paid out 100% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 90% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

As TSA Group Berhad's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

Click here to see how much of its profit TSA Group Berhad paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. TSA Group Berhad's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 43% a year over the past five years.

We'd also point out that TSA Group Berhad issued a meaningful number of new shares in the past year. It's hard to grow dividends per share when a company keeps creating new shares.

This is TSA Group Berhad's first year of paying a regular dividend, so it doesn't have much of a history yet to compare to.

To Sum It Up

From a dividend perspective, should investors buy or avoid TSA Group Berhad? Not only are earnings per share declining, but TSA Group Berhad is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. This is a starkly negative combination that often suggests a dividend cut could be in the company's near future. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

With that in mind though, if the poor dividend characteristics of TSA Group Berhad don't faze you, it's worth being mindful of the risks involved with this business. For example, TSA Group Berhad has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if TSA Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TSA

TSA Group Berhad

An investment holding company, engages in the distribution and supply of ferrous and non-ferrous metal, and other industrial hardware products in Malaysia, Singapore, Bangladesh, Thailand, Indonesia, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives